Space 3.0: Why Nanosatellites Are Reshaping the Space Industry

How small satellites are democratizing access to orbit and accelerating innovation

The space industry is entering a new era. For decades, advanced missions required large, expensive satellites with lengthy development cycles. Today, a shift is underway toward smaller, more innovative, and commercially scalable platforms that deliver meaningful capability at dramatically lower cost and risk.

From Space 2.0 to Space 3.0

Legacy defense programs and mega-class satellites remain essential for national missions, but this model increasingly excludes small innovators, universities, and commercial operators. According to Bryce Tech's 2024 Start-Up Space report, the average development cost for traditional satellites exceeds $150 million, with timelines stretching 5-7 years from contract award to launch. Meanwhile, NASA's Small Business Innovation Research (SBIR) program allocates just $3-5 million per Phase II award - creating a massive funding gap that leaves emerging companies unable to afford domestic spacecraft options. The result is a widening capability gap that forces many startups to look overseas for affordable spacecraft solutions. European and Asian manufacturers now capture an estimated 40-60% of the commercial smallsat market, according to Northern Sky Research, with Chinese suppliers offering turnkey CubeSat solutions at price points often 50-70% below U.S. alternatives.

The transformation is already underway. According to Bryce Tech's 2024 Global Orbital Space Launches report, SpaceX alone completed 134 orbital launches in 2024 - nearly three times more than any other provider and representing approximately 62% of all global orbital activity. This launch cadence, averaging one mission every 2.7 days, has fundamentally restructured access to orbit. What was once a carefully choreographed annual event for most organizations has become a routine commercial service with monthly rideshare opportunities, creating the infrastructure foundation that makes nanosatellite economics viable at scale.

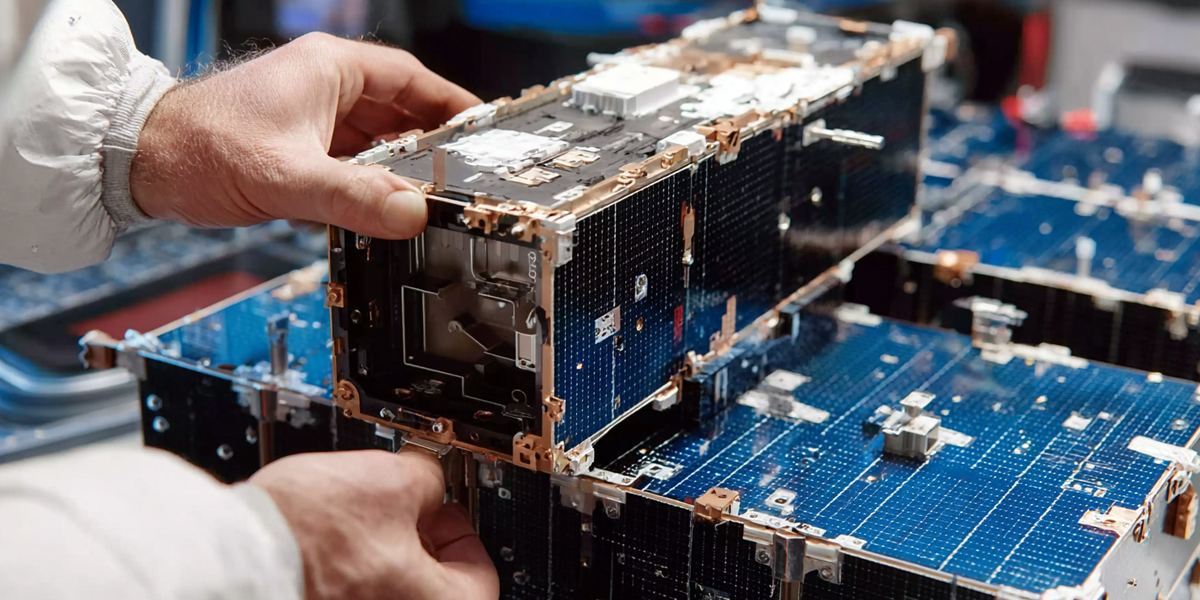

Space 3.0 represents the rise of mass-manufacturable nanosatellites with high compute power and advanced sensing in extremely compact form factors. The performance density shift is remarkable: modern nanosatellites now deploy edge processors exceeding 1 TFLOPS - comparable to desktop workstations from just five years ago - while fitting within 10-20 kg platforms. SpaceWorks' 2024 Nano/Microsatellite Market Forecast documents over 2,800 nanosats launched between 2020-2024, with on-orbit computing capability increasing by roughly 10x during this period.

Better Economics, Faster Iteration

Modern nanosatellites weigh less than 30 pounds (typically 1-10 kg for CubeSat form factors) and cost $50,000-$500,000 rather than millions to produce and launch - representing a 90-95% cost reduction compared to traditional smallsats. Rideshare launch providers, led by SpaceX's Transporter missions, have fundamentally transformed both the cost and availability of orbital access. SpaceX's 134 launches in 2024 created unprecedented manifest frequency while driving deployment costs to approximately $5,000-$10,000 per kilogram, down from over $50,000/kg a decade ago. This combination of frequency and affordability means nanosatellite developers no longer face the traditional choice between waiting eighteen months for an affordable rideshare slot or paying premium prices for faster access. Regular launch opportunities are simply the new baseline. Planet Labs demonstrated this approach by deploying over 200 Dove satellites between 2013-2020, iterating through multiple hardware generations while maintaining continuous operations.

Industry data confirms this momentum. The nanosatellite and microsatellite market nearly doubled from $2.2B in 2020 to $4.0B in 2024, driven by increased commercial deployment, according to NSR's Small Satellite Markets report. Mordor Intelligence forecasts the sector reaching $8.1B by 2030, representing a CAGR of 12.4%. SpaceWorks' annual forecast projects cumulative nanosatellite launches will exceed 3,500 units between 2025-2029 - more than triple the total launched in the preceding five-year period. VC investment in space startups focused on smallsat platforms and applications reached $6.5B in 2023 (per Space Capital), with over 65% targeting commercial Earth observation, IoT connectivity, and on-orbit edge computing applications enabled specifically by nanosatellite economics.

Capability and Mission Diversity

Nanosatellites are powering next-generation applications, including:

- Earth observation and remote sensing

- Internet of Things and RF communications

- Edge processing and AI-enabled automation

- Commercial navigation and GNSS augmentation

- Microgravity research, tech demonstration, and in-orbit manufacturing

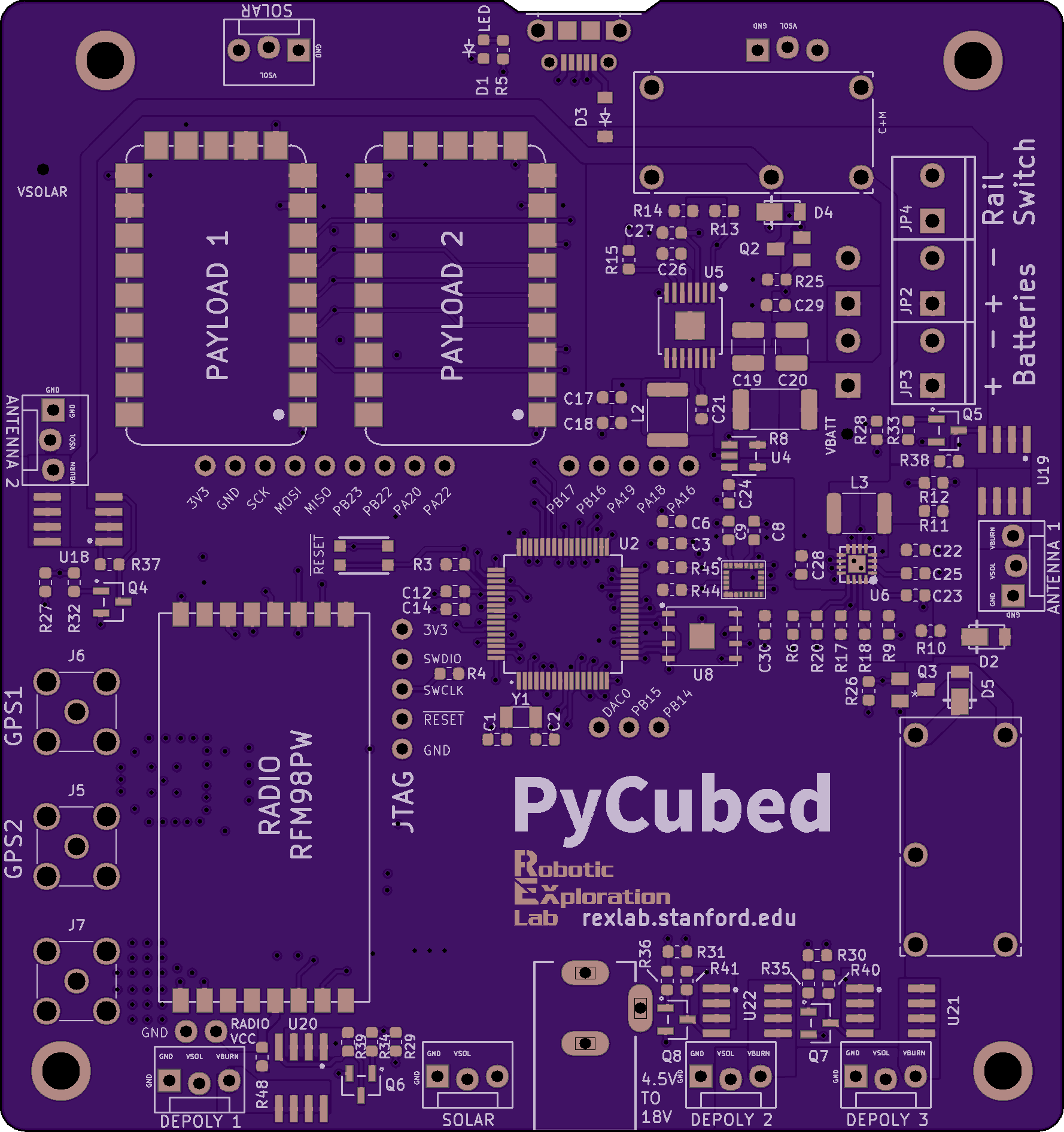

These capabilities are expanding rapidly due to advances in compute density, high-efficiency power systems, and modular avionics.

Shorter Lifecycles, Higher Performance

Instead of designing systems for eight to twelve-year missions - the traditional approach exemplified by programs like GPS III (15-year design life) or commercial GEO satellites (12-15 years) - Space 3.0 operators are adopting two to three-year refresh cycles. Planet Labs replaces its entire Dove constellation approximately every 2-3 years, deploying new generations with improved sensors and processing capabilities while retiring older units. Spire Global follows a similar model, maintaining a constellation of 100+ nanosatellites with planned operational lives of 3-5 years and continuous technology refresh.

This approach keeps fleets modern and mission-aligned as technology advances - leveraging Moore's Law improvements in computing (transistor density doubling every 18-24 months) and the rapid evolution of COTS components. According to Quilty Analytics, the average design life for commercial nanosatellite constellations deployed since 2020 is just 3.2 years, compared to 10.4 years for satellites over 500 kg.

Financial modeling from Canaccord Genuity shows this strategy reduces total capital expenditure by 30-40% over a decade compared to traditional long-life satellites, while maintaining superior technological currency. Organizations avoid long-term capital lock-in: rather than committing $50-200M to a single platform expected to last 15 years, operators can deploy $5-20M assets in waves, preserving optionality and matching capability deployment to actual revenue generation and market demand.

Blackwing Space

Blackwing Space is building for Space 3.0. We design and assemble commercial nanosatellites in Nashville, Tennessee, to strengthen U.S. industrial leadership and provide reliable access to orbit for commercial and research missions.

Our platforms are engineered for:

- Significant cost reduction and transparent pricing

- Rapid integration and fast delivery schedules

- Plug and play payload support following open standards

- Automotive-grade components and prioritized American sourcing

- Flexible delivery models, including turnkey platforms or self-assembly kits

- Optional mission operations, ground stations, and regulatory support

This product-driven approach replaces custom program engineering with an accessible commercial model that removes barriers to launch and scale.

The Future of Space Access

Space 3.0 is defined by capability scaling as costs decline and access expands. When satellites become easier to purchase, integrate, and operate, more organizations can deploy technology to orbit and move faster toward commercial value.

Blackwing Space is committed to enabling that future with American-made nanosatellite platforms that deliver performance, reliability, and affordability from day one.