The $4B Market Nobody's Talking About: Nanosatellites Are Doubling Every 5 Years

Inside the explosive growth of the nanosatellite industry

While media attention gravitates toward billionaire-funded space tourism ventures and ambitious plans to colonize Mars, a more fundamental transformation is quietly reshaping how humanity accesses and uses space. This shift centers on something far less glamorous than interplanetary travel but potentially more consequential: the rapid maturation of small satellite technology and the commercial ecosystems forming around it.

The nanosatellite and microsatellite market nearly doubled from $2.2 billion in 2020 to $4.0 billion in 2024, representing an eighty percent increase in just five years. This trajectory shows no signs of slowing. Rather than following the boom-and-bust cycles that have characterized previous space investment waves, the small satellite sector is demonstrating the sustained growth patterns of a maturing technology finding product-market fit across multiple customer segments.

Consider what this growth represents in practical terms. When Planet Labs deployed its Dove constellation to image the entire Earth daily, it proved that swarms of small, inexpensive satellites could accomplish what previously required billion-dollar government programs. When Spire Global built a business around tracking ships and aircraft from orbit using networks of nanosatellites, it demonstrated that space-based data could compete economically with terrestrial alternatives. These aren't speculative ventures anymore. They're operating businesses with revenue, customers, and validated business models that are pulling investment and talent into the sector.

The Market Fundamentals Point to Sustained Expansion

CubeSat product revenues alone reached nearly five hundred million dollars in 2024, and this represents only one segment of the broader small satellite market. Multiple independent market analyses from firms including Euroconsult, Northern Sky Research, and Frost & Sullivan consistently forecast expansion of several multiples by 2030. The convergence of these independent projections matters because it suggests the growth isn't based on optimistic assumptions from a single source but rather on observable market dynamics that multiple analysts are tracking.

Industry studies consistently project annual growth rates between ten and twenty-three percent across nanosatellite and microsatellite segments. This creates a compounding effect where each year's growth builds on an expanding base. The mathematical result of sustaining double-digit growth through the end of this decade places the total addressable market somewhere between eight and sixteen billion dollars by the early 2030s.

Breaking down where this growth is concentrated reveals important insights about which segments are driving expansion. Earth observation applications currently command the largest share, fueled by demand from agriculture, insurance, defense, and climate monitoring sectors. Communications and connectivity applications are growing even faster in percentage terms as companies race to provide global internet coverage and Internet of Things connectivity. Technology demonstration missions, once primarily the domain of universities, now attract commercial funding as space startups need to validate components and systems before committing to full-scale constellation deployment.

The revenue growth also reflects a shift in who is buying these satellites and why. Early nanosatellite customers were predominantly universities and research institutions conducting scientific experiments. Today's customers increasingly include commercial operators building constellations, government agencies procuring turnkey solutions rather than developing everything internally, and established aerospace companies buying platforms to host proprietary payloads. This diversification of the customer base reduces market risk and creates multiple growth pathways that can develop simultaneously.

Understanding What Drives the Nanosatellite Boom

The expansion of this market rests on several converging technological and economic factors that have fundamentally altered the cost-benefit equation for accessing space. Each of these drivers reinforces the others, creating an accelerating cycle of capability improvement and cost reduction.

Launch economics have undergone the most dramatic transformation. SpaceX's rideshare program allows nanosatellites to reach sun-synchronous orbit for approximately one million dollars per two-hundred-kilogram payload allocation. Compare this to the situation a decade ago when dedicated small satellite launches routinely cost ten to fifteen million dollars, and the improvement becomes clear. Rocket Lab's Electron vehicle pioneered dedicated small payload launches starting around six million dollars per mission, creating a new market segment between rideshare and traditional launch vehicles. The emergence of multiple providers competing in this space, including Virgin Orbit before its closure, Astra, and Firefly Aerospace, continues to drive prices down and service levels up.

These launch cost reductions matter enormously because they change the fundamental economics of satellite programs. When launch represents forty to sixty percent of total mission cost, as it did historically, every design decision optimizes for minimum mass and maximum reliability to protect the launch investment. When launch drops to twenty percent or less of mission cost, as increasingly occurs with nanosatellites flying on rideshare missions, the optimal design point shifts. Programs can accept somewhat higher mass to gain schedule flexibility or can adopt less expensive commercial components knowing that replacement satellites can reach orbit affordably if early units fail.

Miniaturization has progressed to the point where nanosatellites now carry computing power that exceeds what flew on deep space missions twenty years ago. Radiation-tolerant processors originally developed for automotive and industrial applications can now survive the space environment with appropriate testing and qualification. High-resolution cameras that once filled equipment racks now fit in enclosures smaller than a coffee cup. Solar cells have improved efficiency while shrinking in size and weight. Power management systems that regulate satellite electrical systems now occupy circuit boards measured in square inches rather than square feet.

This miniaturization enables capabilities that weren't economically feasible in previous satellite generations. A three-unit CubeSat roughly the size of a loaf of bread can now carry multispectral imaging systems capable of distinguishing between crop types and assessing plant health. Six-unit configurations support hyperspectral sensors that analyze dozens of wavelength bands for applications ranging from mineral exploration to environmental monitoring. Twelve-unit and larger nanosatellite form factors accommodate communications payloads competitive with traditional smallsats while maintaining the cost advantages of standardized design and commercial components.

The applications emerging from these improved capabilities span an impressive range. Global Internet of Things connectivity allows companies to monitor shipping containers, track agricultural equipment, and manage remote infrastructure anywhere on Earth without depending on cellular coverage. Spire Global has built a viable business around this model, providing connectivity services to logistics and transportation customers who need global coverage that terrestrial networks cannot economically provide.

Earth observation for climate tracking and agricultural optimization represents the largest current application segment by revenue. Planet Labs operates more than two hundred satellites that image the Earth's entire landmass daily, providing a continuous record of surface changes that supports applications from crop yield prediction to disaster response. BlackSky operates a constellation focused on high-revisit imaging that can monitor specific locations multiple times per day, serving customers who need near-real-time awareness of ground conditions.

Communications and data services for underserved regions are attracting substantial investment as companies work to close the digital divide in rural and developing areas. While OneWeb and Starlink operate larger satellites in their constellations, the fundamental business model of providing connectivity from low Earth orbit has validated the market and created opportunities for specialized providers serving specific geographic regions or customer segments with nanosatellite-based solutions.

Technology demonstrations for space startups and research institutions continue to grow as more companies pursue space-based business models. Rather than committing hundreds of millions to full-scale constellations before proving technology works in orbit, companies can fly pathfinder missions on nanosatellite platforms for a few million dollars. This de-risks subsequent investment and provides real performance data rather than relying solely on ground testing and simulation.

Edge computing and onboard artificial intelligence processing represent emerging application areas where nanosatellites offer distinct advantages. Processing data in orbit and downlinking only relevant information reduces ground station bandwidth requirements and enables faster response to time-sensitive observations. Satellites equipped with machine learning algorithms can identify ships in maritime zones, detect changes in forest cover, or flag anomalous events without human intervention, downlinking alerts rather than raw imagery.

In-orbit manufacturing and materials research exploits the unique environment of space to produce materials or structures difficult to create under Earth's gravity. While most such research currently flies on the International Space Station, nanosatellite platforms are beginning to host automated experiments at a fraction of ISS costs, opening space-based manufacturing research to a broader range of organizations.

The Transition from Academic Projects to Commercial Operations

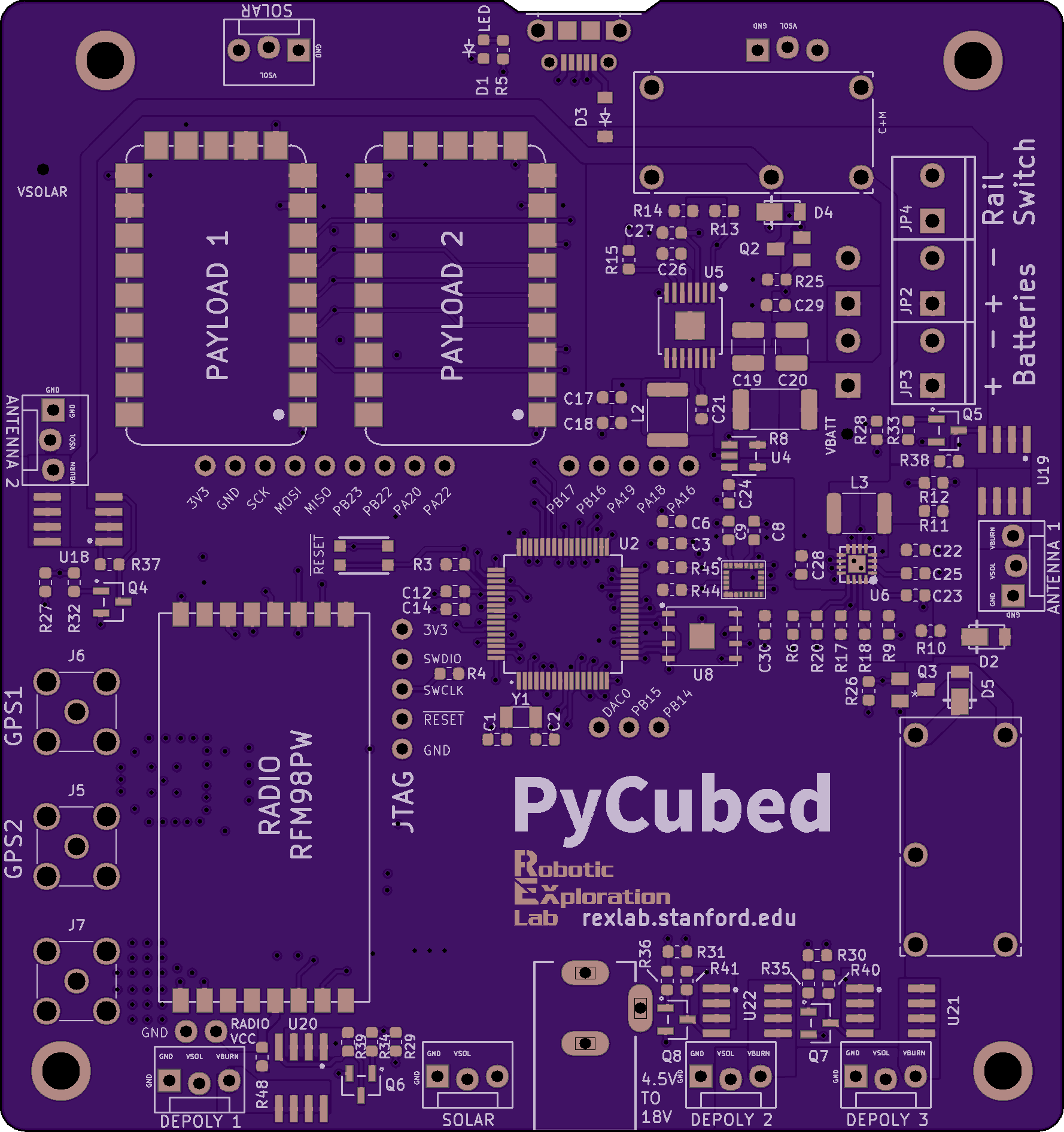

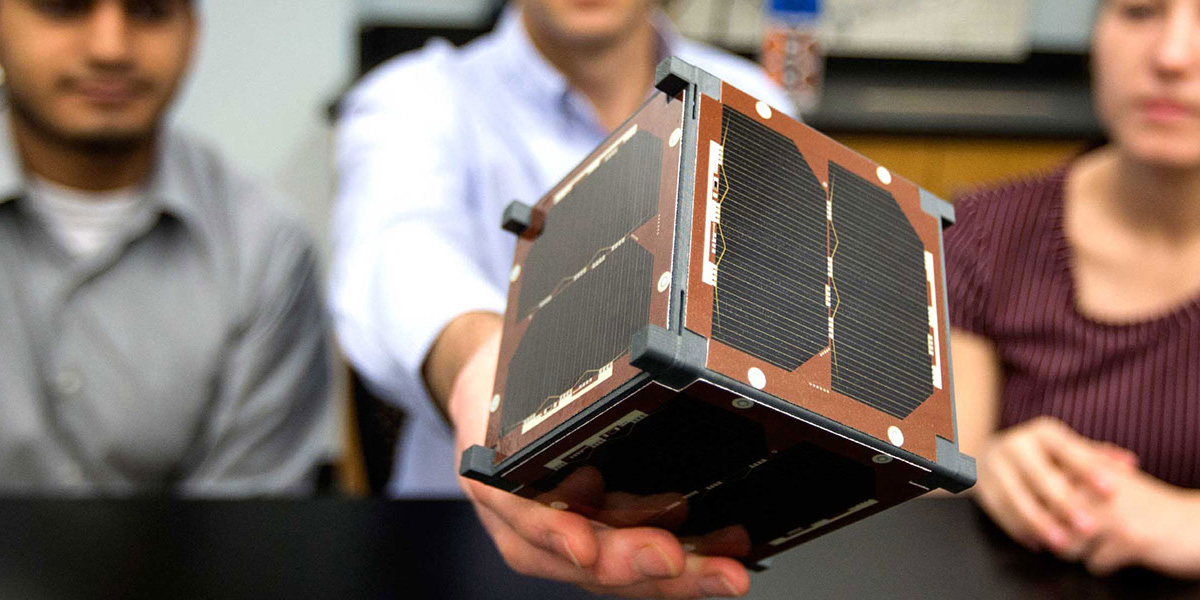

Nanosatellites originated in university laboratories as educational platforms designed to give students hands-on experience with satellite development in compressed timeframes. The CubeSat standard emerged from California Polytechnic State University and Stanford University in 1999 as a way to reduce the cost and complexity of student satellite projects. That academic foundation proved the fundamental viability of highly standardized, miniaturized satellite platforms and trained a generation of engineers who later founded companies commercializing the technology.

The breakthrough moment came when these university-developed platforms demonstrated they could perform real operational missions rather than just educational experiments. The PhoneSat project at NASA Ames Research Center flew smartphones as satellite avionics in 2013, proving that commercial consumer electronics could function in orbit. Planet Labs, founded by former NASA scientists in 2010, deployed the first Dove satellites in 2013 and demonstrated that fleets of nanosatellites could provide commercially valuable Earth observation data. These early successes attracted venture capital investment and triggered the transition from primarily academic projects to commercially focused development.

Government agencies recognized the potential earlier than many expected. NASA established the CubeSat Launch Initiative in 2010 to provide flight opportunities for educational institutions, later expanding it to include commercial providers demonstrating technologies relevant to NASA missions. The National Reconnaissance Office began experimenting with CubeSats for tactical applications, proving that national security missions could benefit from small satellite capabilities. The Air Force Research Laboratory invested in nanosatellite technology development through programs focused on rapid capability delivery and on-orbit experimentation.

This government engagement accelerated commercial development by providing early customers, validating requirements, and demonstrating applications. Rather than building everything internally as space agencies traditionally did, government organizations increasingly contract with commercial nanosatellite suppliers to deliver specific capabilities. This creates more predictable revenue streams for commercial providers and reduces development risk compared to purely commercial markets where customer adoption might take years to materialize.

Blackwing Space is building for this mature phase of the market by delivering commercial nanosatellite platforms and turnkey solutions designed specifically for scaled manufacturing, shorter mission development cycles, and reliable on-orbit performance. Rather than treating each satellite as a custom one-off development, the focus is on standardized platforms that customers can configure for specific missions while maintaining the cost and schedule benefits of proven designs.

The Global Nature of Nanosatellite Competition

The United States maintains its position as the leader in nanosatellite deployment and payload innovation, accounting for approximately sixty percent of global nanosatellite launches by number. American companies dominate the commercial Earth observation and connectivity segments, and U.S. government agencies remain the largest customers for small satellite capabilities. However, the market has become thoroughly global in both participation and competition.

European providers have established strong positions in commercial nanosatellite manufacturing and mission services. GomSpace, headquartered in Denmark, ships complete nanosatellite platforms to customers worldwide and has flown dozens of missions across commercial and government programs. EnduroSat, based in Bulgaria, offers turnkey nanosatellite solutions combining bus platforms with ground station services and mission operations. These European companies compete effectively on both capability and cost, particularly in international markets where geopolitical considerations may favor non-U.S. suppliers.

Asian space programs are scaling rapidly with particularly aggressive expansion in China and India. China launched more than sixty small satellites in 2023 alone, a mix of government and commercial missions spanning communications, Earth observation, and technology development. Chinese nanosatellite manufacturers including Spacety and MinoSpace are developing indigenous platforms and pursuing international customers. India's space program has successfully deployed nanosatellites for government missions and is supporting a growing commercial sector through ISRO's small satellite launch capabilities and technology transfer programs.

Emerging space nations view nanosatellites as an achievable entry point into aerospace industries that doesn't require the massive infrastructure investments of traditional space programs. Countries including the United Arab Emirates, Saudi Arabia, Luxembourg, and New Zealand have all launched nanosatellite programs in recent years. This global participation increases competitive pressure across the industry and drives innovation cycles as companies from different regions bring varying approaches to satellite design, manufacturing, and operations.

For U.S.-based manufacturers like Blackwing Space, this global competition creates both challenges and opportunities. The challenge is competing with international providers who may have lower labor costs or benefit from government subsidies. The opportunity lies in positioning American engineering and manufacturing as premium qualities that deliver superior reliability, compliance with rigorous standards, and alignment with U.S. government security requirements. Customers who value these attributes, particularly U.S. defense and intelligence agencies, national security allies, and commercial operators with strict quality requirements, represent a substantial and growing market segment where domestic sourcing provides competitive advantages.

Investment Capital Continues Flowing Into the Sector

Venture capital investment in space technology companies exceeded nine billion dollars in 2021 and has remained above five billion dollars annually despite broader technology market corrections. Nanosatellite companies capture a meaningful portion of this investment, benefiting from relatively low capital requirements compared to launch vehicle or large satellite programs and the ability to demonstrate technical traction early in development through pathfinder missions.

Strategic partnerships between established aerospace primes and nanosatellite operators are expanding the ecosystem by combining manufacturing scale and market access with innovative operating concepts and agile development practices. Lockheed Martin has invested in and partnered with multiple small satellite companies. Northrop Grumman acquired Orbital ATK in part to expand its small satellite capabilities. Boeing operates a venture capital arm focused on space technology. These strategic relationships provide credibility, customer introductions, and often acquisition pathways that reduce investor risk.

The investment climate has matured substantially from the early days when space technology was considered highly speculative. Investors now have visibility into revenue traction, customer adoption rates, and unit economics for nanosatellite businesses. Companies can raise capital based on demonstrated performance rather than purely on technology promises. This shift toward data-driven investment decisions supports sustained capital availability even during broader economic uncertainty.

With commercial customers, validated revenue models, and scalable deployment pathways now clearly established, investor confidence in the nanosatellite sector continues to strengthen even as other technology segments face headwinds. The combination of government procurement creating baseline demand, commercial applications generating recurring revenue, and international market expansion providing growth options creates an investment profile that appeals to both venture capital seeking growth and strategic investors focused on long-term positioning.

Infrastructure Challenges Create Competitive Opportunities

The rapid expansion of on-orbit nanosatellite populations creates real infrastructure challenges that the industry must address to sustain growth. Orbital debris mitigation has evolved from a theoretical concern to an immediate operational requirement. The Federal Communications Commission now requires satellite operators to deorbit satellites within five years of mission completion, down from the previous twenty-five-year standard. Compliance requires propulsion systems or drag augmentation devices that increase satellite complexity and cost but are essential for long-term space sustainability.

Radio frequency management grows more complex as satellite populations increase and spectrum allocations become more constrained. Coordination between operators to prevent harmful interference requires sophisticated frequency planning and sometimes operational adjustments to avoid conflicts. Regulators including the FCC and International Telecommunication Union are developing new frameworks for spectrum management in congested orbital regimes, and operators must navigate these evolving requirements.

Supply chain maturation represents both a challenge and an opportunity as the industry scales from dozens of satellites per year to potentially thousands. Component suppliers must increase production volumes while maintaining quality and reliability. Manufacturing facilities need to adopt automated processes that support higher throughput without sacrificing the flexibility to accommodate different payload configurations. Quality control and testing processes must scale efficiently without creating bottlenecks that slow delivery schedules.

Companies that successfully solve these infrastructure challenges will secure significant competitive advantages. Blackwing Space has embraced responsible orbital stewardship through design choices that support compliant deorbit capability and modular architectures that simplify manufacturing scaling. By incorporating commercial automotive-grade components that benefit from high-volume production and established supply chains, Blackwing reduces exposure to the supply constraints that affect space-specific components while maintaining performance requirements.

The Path Forward Through Industry Execution

Reaching the projected eight to sixteen billion dollar market valuation by the early 2030s depends on continued execution across multiple dimensions. Launch costs must continue declining through increased competition, higher flight rates that spread fixed costs, and reusable vehicle technology reaching full operational maturity. Commercial business models must demonstrate consistent customer value that justifies recurring revenue rather than one-time purchases. Component manufacturers must continue delivering performance improvements in miniaturized form factors while maintaining or reducing costs.

Regulatory frameworks must evolve to support both sustainability and expanded access to spectrum and orbital resources. Current regulatory processes often move slower than technology development, creating uncertainty for operators planning future constellations. Streamlined licensing procedures that maintain safety and interference protection while reducing administrative burden would accelerate deployment and reduce regulatory risk.

Rapid manufacturing enabled by modular design philosophies represents a critical enabler for scaling production to meet growing demand. Traditional satellite manufacturing treats each spacecraft as a custom project requiring extensive integration and testing. Nanosatellite economics require factory-style production where standardized platforms move through defined manufacturing and test sequences with minimal customization. Companies that perfect this manufacturing approach will capture disproportionate market share as demand accelerates.

Blackwing Space was created specifically to support this next phase of industry growth through commercially viable, American-made nanosatellite platforms that reduce cost barriers and expand access to orbit for customers who value domestic sourcing, proven reliability, and mission-focused customization within standardized frameworks.

The Most Scalable Opportunity in Orbit

The nanosatellite sector may not generate the same media attention as crewed missions to the Moon or ambitious plans for Mars colonies, but it represents the most scalable commercial opportunity in orbit today. The market fundamentals are strong and getting stronger. Technology capabilities continue accelerating. Investment capital remains available for companies demonstrating traction. Customer demand spans commercial, government, and international segments with diverse application requirements.

The transformation is already well underway. What began as university educational projects has evolved into a multi-billion-dollar industry deploying hundreds of operational satellites annually. The next phase of growth will see thousands of nanosatellites supporting critical infrastructure for communications, Earth monitoring, and emerging applications we're only beginning to understand.

For organizations looking to access this growth, whether as satellite operators, payload developers, or service providers, the window for establishing strong competitive positions remains open but is narrowing as the market matures. Contact Blackwing Space to explore mission opportunities and learn how American-made nanosatellite platforms can support your orbital objectives.