Where Are All the CubeSat Manufacturers? Consolidation, Costs, and the Case for American Innovation

How industry consolidation and foreign dominance created a gap in affordable U.S. nanosatellite access

Fifteen years ago, the CubeSat revolution promised a future of rapid experimentation and democratized space access. University researchers, startup founders, and even high schools could design, build, and launch satellites at a fraction of traditional aerospace costs. And they did, in the hundreds.

But the landscape in 2025 looks dramatically different than it did in the early CubeSat era.

The first wave of CubeSat suppliers has largely been absorbed into larger defense oriented conglomerates. Others have doubled down on commercial or European markets where cost, export, and regulatory friction complicate U.S. educational access. Still others pivoted away from providing complete platforms, leaving teams to assemble spacecraft from scattered components.

So what happened? And more importantly, where does the next generation of space innovators turn for accessible American made platforms?

The Great Consolidation: When CubeSat Pioneers Became Defense Divisions

Several once independent CubeSat pioneers now operate under major primes or government oriented aerospace groups, fundamentally changing their business models and customer priorities.

Blue Canyon Technologies: From University Partner to Raytheon Asset

Blue Canyon Technologies built its reputation as the gold standard for CubeSat attitude determination and control systems, expanding into complete small satellite platforms. Their systems powered some of the most successful university and commercial missions of the 2010s.

Then Raytheon acquired Blue Canyon in 2020. While the technical quality remained high, the business model shifted decisively toward high end national security missions. Prices increased substantially, minimum order quantities rose, and university programs found themselves competing for attention with classified government contracts.

A single university CubeSat is no longer a strategic priority when your parent company is delivering billion dollar defense systems.

GomSpace and NanoAvionics: The European Consolidation

GomSpace, the Danish CubeSat pioneer, and NanoAvionics from Lithuania represent high quality European manufacturing. Both companies have built impressive flight heritage and capable platforms.

But for U.S. customers, especially universities and startups, working with European suppliers introduces significant friction including ITAR and EAR export complexity requiring careful technology transfer controls, currency fluctuations adding budget uncertainty, transatlantic logistics extending lead times, training and integration support requiring international travel, and longer procurement cycles conflicting with academic calendars.

What appears affordable on a spec sheet becomes expensive once compliance costs, shipping delays, and support complexity are factored in.

AAC Clyde Space: When Independence Disappears

Clyde Space, originally a Scottish company serving the university CubeSat market, was acquired by Swedish aerospace conglomerate AAC Microtec in 2017 to form AAC Clyde Space. The company then acquired ISISpace, the Dutch CubeSat manufacturer, in 2021.

The consolidation created a larger European entity focused on commercial constellation customers rather than one off educational missions. Prices rose accordingly, and the focus shifted away from the accessible scrappy university market toward revenue generating commercial contracts.

University programs that relied on Clyde Space as an affordable partner found themselves priced out or facing minimum order quantities incompatible with single mission demonstrations.

Pumpkin Space Systems: Components Without Complete Solutions

Pumpkin Space Systems remains a respected provider of CubeSat components and development kits. Their CubeSat Kit products serve the educational market well for learning and prototyping.

However, Pumpkin does not offer complete flight ready integrated platforms in the way early CubeSat suppliers did. Universities seeking a turnkey classroom to orbit solution must source, integrate, and test subsystems from multiple vendors, dramatically increasing complexity, cost, and timeline.

For first time university programs without extensive systems engineering experience, this component based approach introduces failure modes that delay or cancel missions entirely.

The European Ecosystem: Quality Platforms, U.S. Barriers

While American CubeSat manufacturers consolidated or exited, European players expanded. EnduroSat in Bulgaria, NanoAvionics in Lithuania, and others built impressive technical capabilities and accumulated substantial flight heritage.

These companies serve European customers well. But U.S. universities, startups, and research institutions face significant barriers when procuring foreign platforms.

Export Control Complexity

Any technical exchange with a foreign entity potentially triggers ITAR or EAR requirements. Even routine integration support calls can require export licenses and careful documentation. University teams with international students face additional complications, as sharing controlled technical data with non U.S. persons may constitute an export even within a campus lab.

Federal grant programs, especially those from AFRL, NASA, or emerging Space Force initiatives, increasingly scrutinize foreign content. Missions funded by U.S. taxpayers face pressure to support domestic manufacturing and avoid supply chain vulnerabilities.

Hidden Costs and Timeline Risks

European platform pricing may appear competitive, but U.S. customers quickly discover hidden costs including import duties and customs fees, international shipping with extended lead times, currency exchange risk over multi year programs, travel costs for integration support and training, and compliance overhead for documentation and licensing.

More critically, geopolitical disruptions can introduce catastrophic delays. Supply chain issues, export policy changes, or international conflicts can ground missions or force expensive last minute redesigns.

Support and Responsiveness

Time zone differences, language barriers, and transatlantic logistics complicate support relationships. When a university team encounters an integration issue two weeks before delivery deadline, waiting for a response from a European vendor in a different time zone can mean missing a launch opportunity.

Domestic suppliers provide same day support, on site assistance when needed, and alignment with U.S. academic calendars and launch schedules.

The Disappearing Middle: Where Are the U.S. Commercial CubeSat OEMs?

In the rush toward Space 2.0 with bigger more powerful Starship scale satellites, commercial availability in the CubeSat class has shrunk dramatically.

The industry bifurcated into two extremes: mega satellites costing millions for defense customers and constellation operators, and educational kits that rarely achieve flight readiness.

The critical middle ground disappeared: affordable flight proven complete platforms manufactured in the United States with transparent pricing and rapid delivery.

This gap leaves multiple constituencies underserved:

U.S. Startups Requiring Agile Technology Demonstrations

Early stage space companies need to demonstrate technology in orbit quickly and affordably to attract follow on investment. But options are limited to expensive defense contractor platforms, foreign suppliers with export complications, or risky build it yourself approaches.

Many promising space technologies never reach orbit simply because the cost and complexity of the demonstration platform exceeds available seed capital.

Universities Bidding for NASA CSLI Launches

NASA CubeSat Launch Initiative provides free launch services but not satellite hardware. Universities must secure separate funding for platforms, often through NSF grants or institutional cost sharing.

When platform options are limited to $150,000 plus legacy aerospace suppliers or foreign manufacturers with compliance headaches, many universities abandon missions entirely or limit their proposals to less ambitious projects.

Researchers Testing Instruments and Materials in LEO

Materials scientists, electronics researchers, and instrument developers need affordable access to the space environment for testing and validation. CubeSats should be the perfect platform for these experiments.

Instead, researchers face platforms that cost more than their entire grant budgets, forcing them to abandon space testing or settle for inadequate ground based simulation.

Government Labs Needing Small Scale Flight Heritage

Air Force Research Laboratory, Space Force, and NASA centers need rapid low cost pathfinder missions to validate concepts before committing to larger programs.

But procurement rules favor established defense contractors, and the disappearance of U.S. commercial CubeSat manufacturers means fewer options for rapid responsive space demonstrations.

Market Data: The Cost Escalation Problem

University CubeSat programs report consistent year over year cost increases. A 3U platform that cost $80,000 in 2015 now runs $200,000 to $350,000 from traditional suppliers. Lead times have stretched from 6 months to 18 months or longer.

Meanwhile, the nanosatellite market overall has exploded from $2.2 billion in 2020 to $4.0 billion in 2024, an 80 percent increase in just five years. But this growth has been captured primarily by large constellation operators and defense customers, not the educational and early stage innovation market that birthed the CubeSat revolution.

The democratization promise of CubeSats is being undermined by consolidation and cost escalation.

Enter Space 3.0: A Return to Accessible Agility

The industry needs a correction. Space 3.0 represents a return to the original CubeSat vision: accessible platforms that enable rapid iteration, lower risk experimentation, and broad participation in space innovation.

Blackwing Space is part of the new generation of American made nanosatellite manufacturers emerging to restore accessibility and agility to the CubeSat category.

The company is building commercial off the shelf nanosatellite platforms designed for rapid mission deployment, manufactured at The Nest facility in Franklin Tennessee, just outside Nashville.

Key Differentiators: Making Space Accessible Again

Transparent, Affordable Pricing

Blackwing platforms start at $10,000 for the 1U Sparrow, $50,000 for the 3U XL Kestrel, and $100,000 for the 6U XL Osprey. Pricing is published, transparent, and consistent for all customers. No tiered pricing favoring defense contractors. No hidden fees or surprise costs.

This represents a 50 to 80 percent cost reduction compared to traditional small satellite platforms while maintaining flight proven reliability through automotive grade components and smart protective engineering.

Modular Plug and Play Architecture

Standardized payload interfaces following open CubeSat standards support multiple mission types without custom integration engineering. Universities can focus on their research payload rather than reinventing power systems or attitude control.

Plug and play modularity enables rapid payload swaps, mission repurposing, and technology upgrades without full spacecraft redesigns.

Web Based Configuration and Ordering

Rather than months of proposal requests and contract negotiations, customers can configure missions and receive instant pricing through web based tools. This eliminates the traditional aerospace sales cycle that adds cost and delays programs.

Rapid Development and Delivery

Blackwing targets 6 to 9 month delivery cycles from order to delivery, enabled by modular architecture, domestic supply chains, and manufacturing process optimization. For university programs with student graduation timelines to consider, this speed matters enormously.

Turnkey Support Services

Everything as a Service infrastructure includes FCC licensing support, ground station access, mission operations assistance, and data processing. First time space teams can focus on their mission rather than becoming experts in regulatory compliance and RF operations.

Domestic Supply Chain and ITAR Compliance

American made platforms with domestic first supply chains eliminate export control complications. Technical discussions happen without triggering export filings. Support is same day in compatible time zones. And federal grant reviewers favor domestic manufacturing that keeps taxpayer dollars in the U.S. economy.

Platforms are compatible with standard deployers including SEOPS Equalizer Flex, Maverick Space NLAS, and Exolaunch EXOpod Nova, covering the vast majority of university and commercial launch opportunities.

Why Domestic Manufacturing Matters Beyond Patriotism

The push for American made nanosatellites is not merely about economic nationalism. Practical operational advantages make domestic platforms objectively better for U.S. customers.

Speed and Responsiveness

Same country manufacturing means same day communication, site visits when needed, and alignment with U.S. academic and fiscal year calendars. No waiting for responses across eight time zones. No navigating international holidays that halt production.

Supply Chain Resilience

Recent geopolitical disruptions have highlighted supply chain vulnerabilities. Platforms with primarily domestic supply chains are immune to international trade disputes, export policy changes, or foreign supplier business failures.

Federal Funding Compliance

NASA, NSF, AFRL, and emerging Space Force programs increasingly scrutinize foreign content in taxpayer funded missions. Domestic platforms remove a major source of proposal risk and grant reviewer objections.

Intellectual Property Protection

When developing novel payloads or conducting sensitive research, retaining IP control matters. Domestic integration and testing keeps sensitive technical data within U.S. jurisdiction and regulatory protection.

Who Benefits From Renewed CubeSat Accessibility

Affordable American made platforms restore opportunities for constituencies that have been priced out or complicated out of space access.

University Research Programs

Universities can propose ambitious NASA CSLI missions knowing platform costs will not consume entire grant budgets. Graduate students can complete missions within degree timelines. Faculty can build sustained programs rather than one off demonstrations.

Early Stage Startups

Space entrepreneurs can demonstrate technology in orbit with seed capital rather than requiring Series A funding just to prove a concept. Rapid iteration enables fail fast learn faster approaches that drive innovation.

Government Research Labs

AFRL, Space Force, and NASA centers can rapidly field pathfinder missions to inform larger program decisions. Tactically responsive space becomes economically viable when platforms cost five figures rather than six or seven.

STEM Education Programs

High schools and community colleges can introduce students to real space systems engineering without requiring million dollar facilities or multi year development cycles. Hands on learning with flight hardware inspires the next generation of aerospace engineers.

Commercial Payload Developers

Companies developing Earth observation sensors, communications payloads, or edge computing systems can validate products in orbit affordably before scaling to larger platforms. The CubeSat becomes a proving ground rather than a final product.

Market Opportunity: The Gap Is Widening

While mega satellite programs capture headlines, the accessible CubeSat market represents substantial opportunity.

CubeSat product revenues reached nearly $500 million in 2024, with analysts forecasting several fold expansion through 2030 as platforms transition from primarily R and D use to large scale commercial deployment.

The universities alone represent significant volume. Over 300 U.S. universities have aerospace engineering programs. NASA CSLI typically receives 50 to 80 applications per cycle with only 20 to 30 percent acceptance rates. Improving platform affordability and availability would enable more programs to compete and more missions to fly.

Early stage space startups raised over $6 billion in venture capital in 2023 and 2024 combined. Many of these companies need CubeSat class demonstrations to prove technology and attract follow on funding. An affordable domestic platform market could accelerate dozens or hundreds of space startups.

Beyond Platforms: Building an Ecosystem

The new generation of U.S. CubeSat manufacturers is not just selling hardware. They are building ecosystems that enable innovation.

Open Standards and Partner Networks

Open architecture platforms encourage third party payload developers, software tool creators, and ground segment providers to build compatible products. This ecosystem approach accelerates innovation and gives customers choice.

Educational Partnerships

Direct partnerships with universities provide students hands on experience with flight hardware while giving manufacturers valuable feedback on user experience and failure modes. This virtuous cycle improves products while training the next generation workforce.

Regional Manufacturing Hubs

Establishing space manufacturing in regions beyond traditional aerospace centers distributes economic opportunity and builds local supply chains. Tennessee advanced manufacturing ecosystem, for example, provides Blackwing Space with world class automotive grade suppliers and skilled workforce while keeping costs below coastal aerospace hubs.

Learning From the Consolidation Cycle

The consolidation of first generation CubeSat manufacturers provides important lessons for the emerging Space 3.0 companies.

Resist Acquisition Pressure

Staying independent preserves mission focus on accessible platforms rather than pivoting to high margin defense contracts. Long term value creation comes from serving broad markets, not becoming a division of a prime contractor.

Maintain Transparent Pricing

Once companies adopt aerospace industry practices of opaque proposal based pricing, accessibility suffers. Commercial catalog pricing with consistent margins for all customers preserves the democratization mission.

Prioritize Speed and Iteration

Aerospace bureaucracy creeps in slowly. Maintaining startup speed culture and rapid iteration cycles keeps platforms affordable and responsive to customer needs. The moment development cycles stretch to three years, you have become the problem you set out to solve.

Serve the Underserved

Defense contractors and large constellation operators have plenty of supplier options. The underserved markets of universities, startups, and research institutions represent both business opportunity and social impact.

A Market Returning to Its Roots

We are entering what many call Space 3.0, a future where smaller is smarter and space is once again within reach for researchers testing new sensors and materials in LEO, entrepreneurs validating on orbit product concepts, state universities beginning their first space missions, advanced STEM programs preparing tomorrow aerospace workforce, and government labs rapidly demonstrating emerging capabilities.

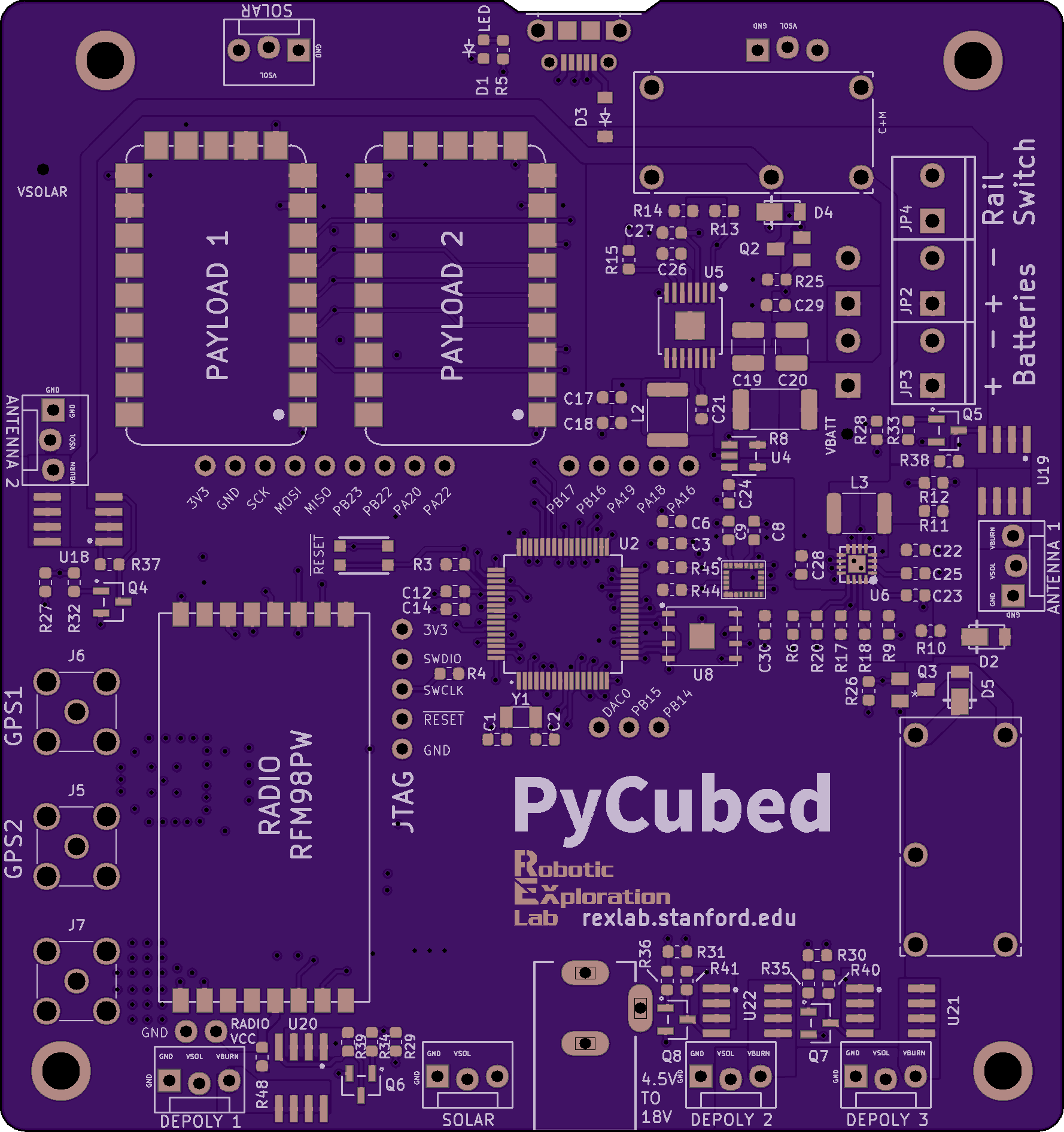

The CubeSat started as a scrappy learn by flying invention developed at Cal Poly and Stanford. The industry next chapter depends on keeping that spirit alive with platforms that are affordable, modular, designed for iteration, and manufactured in America.

A new generation of American manufacturers, including Blackwing Space, is stepping up to ensure space access does not become the exclusive territory of mega programs and multibillion dollar primes.

Space does not need to get bigger to make a bigger impact. Sometimes the strongest innovation still comes in 1U packages.

The original CubeSat vision promised democratized space access. That promise was temporarily interrupted by consolidation, cost escalation, and complexity. But the fundamentals that made CubeSats revolutionary have not changed. Small satellites still offer rapid iteration, lower risk, and accessible experimentation.

What changed is the supplier landscape. Now a new generation is restoring what was lost: affordable American made platforms that put space within reach of anyone with ideas worth testing in orbit.

The question is not whether small satellites have a future. The question is whether we will rebuild the accessible ecosystem that made the CubeSat revolution possible in the first place.

Space 3.0 answers yes.

Ready to launch your mission without the complexity, cost, and compliance headaches of legacy suppliers or foreign platforms? Contact Blackwing Space to discuss how American made nanosatellites can accelerate your path to orbit: sales@blackwingspace.com

Learn More: