Launch Integrators and Service Providers

Navigating the Rideshare Revolution

When you've built your first CubeSat or designed your nanosatellite platform, when you've secured funding and completed testing and obtained your FCC license, you face a fundamental question that determines whether your mission actually flies: how do you get to orbit? For most small satellite developers, the answer isn't launching a dedicated rocket but rather purchasing a slot on a rideshare mission, where your spacecraft shares launch vehicle capacity with dozens of other satellites headed to similar orbits. This seemingly straightforward transaction actually involves a complex ecosystem of launch service providers, mission integrators, deployment specialists, and regulatory coordinators that has evolved dramatically over the past fifteen years. Understanding this ecosystem, knowing who the major players are and what services they actually provide, becomes essential for anyone planning to operate satellites in the modern space economy.

The Rideshare Revolution: From Secondary Payloads to Primary Business Model

To appreciate how launch integration works today, we need to understand how the industry arrived at this point. For most of space history, satellites either purchased dedicated launches where they were the only payload, or if they were small enough and lucky enough, they might hitch a ride as a secondary payload when a larger satellite had extra capacity on its rocket. This secondary payload approach was opportunistic and unpredictable. You might wait years for a suitable opportunity where a primary mission was going to your desired orbit and happened to have spare capacity, and even then you'd be entirely subject to the primary payload's schedule and requirements. If the primary mission slipped or changed orbits, your secondary payload went along for the ride or got bumped entirely.

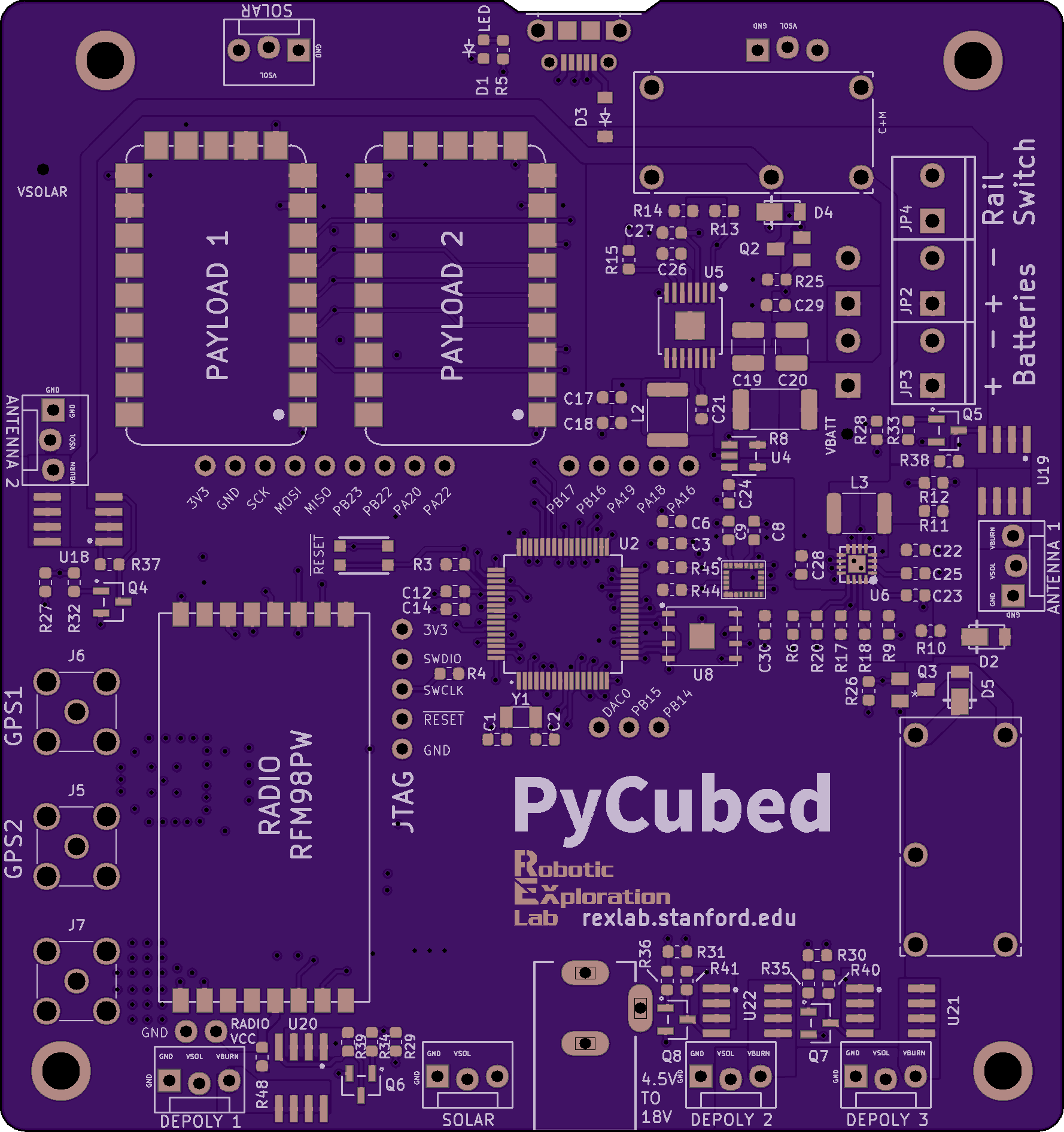

The transformation began in earnest in the late 2000s and early 2010s when several factors converged to create a genuine rideshare market. Launch vehicle providers, particularly SpaceX with their Falcon 9, achieved dramatic improvements in lift capacity and cost efficiency that created substantial excess capacity on many missions. Rather than flying partially empty rockets, providers recognized they could fill remaining capacity with small satellites and generate additional revenue. Simultaneously, the CubeSat revolution was creating unprecedented demand for launch opportunities from universities, research institutions, and early commercial operators who needed affordable access to space but could never justify dedicated launches. The standardization of CubeSat deployers, particularly the Poly Picosatellite Orbital Deployer design from Cal Poly, created a common mechanical interface that made it practical to integrate multiple small satellites onto a single mission.

What emerged from these convergent trends was a new business model where launch service providers would purchase bulk capacity on rockets and then resell individual slots to small satellite operators, aggregating many customers onto shared missions. This rideshare approach fundamentally changed the economics of small satellite deployment. Instead of needing to find twenty or thirty other organizations willing to share a dedicated small launch vehicle, or waiting indefinitely for a lucky secondary payload opportunity, CubeSat developers could simply purchase a standardized deployment slot with known pricing and schedule, much like buying a plane ticket rather than chartering an entire aircraft.

The rideshare model matured through the 2010s as dedicated rideshare missions became commonplace rather than exceptional. SpaceX's Transporter program, which began in 2021, epitomizes this evolution by offering regular, scheduled rideshare missions to sun-synchronous orbit with published pricing and frequent launch opportunities. These missions carry dozens or even over a hundred small satellites from various customers, with the entire manifest organized specifically around rideshare rather than small satellites being squeezed onto missions primarily dedicated to other payloads. This shift from opportunistic secondary payload arrangements to systematic, scheduled rideshare services created the foundation for the launch integration industry as it exists today.

Understanding Launch Integrators: The Critical Middlemen

When a small satellite operator wants to fly on a rideshare mission, they rarely contract directly with the launch vehicle provider. Instead, they work with launch integrators who serve as sophisticated middlemen coordinating the complex process of getting multiple satellites from various customers onto a rocket and safely deployed in orbit. Understanding what integrators actually do helps clarify why this industry segment exists and why most satellite operators find working with integrators preferable to trying to manage launch contracts directly.

Launch integrators start by purchasing bulk capacity from launch vehicle providers, essentially buying large portions of rocket payload capacity that they'll then subdivide and resell to their customers. This bulk purchasing gives integrators economies of scale and negotiating leverage that individual small satellite operators would never achieve. The integrator then markets this capacity to potential customers, providing transparent pricing, schedule information, and clear specifications for what kinds of satellites can fly on particular missions. This aggregation function transforms launch capacity from a bespoke, negotiated commodity into something much more like a standardized product with published rates and availability.

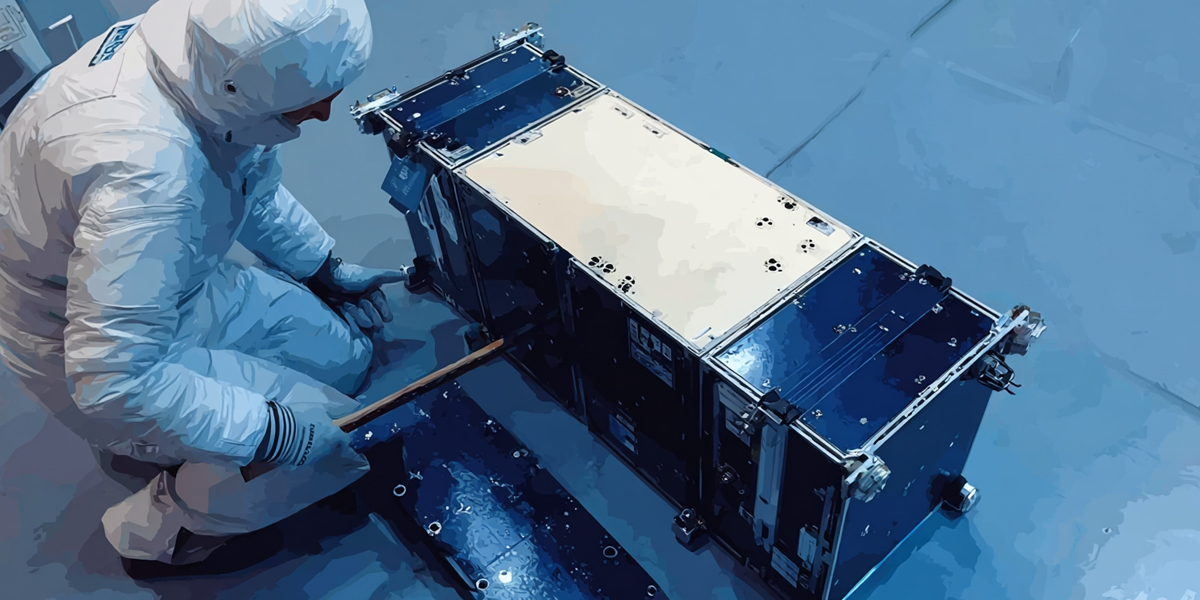

Beyond simple capacity aggregation, integrators provide critical technical services that make rideshare missions practical. They manage the complex orbital mechanics of determining which satellites can share missions based on their desired orbits, coordinating with launch providers to understand what orbits are achievable and with customers to understand what orbits they require. They handle the mechanical integration of physically mounting satellites into deployers or onto dispensers, ensuring that everything fits correctly and meets mass, center of gravity, and structural requirements. They coordinate testing and verification activities, often operating integration facilities where satellites come together weeks before launch for final fit checks, mass properties measurements, and environmental testing.

The regulatory and administrative services integrators provide are equally important even if less technically glamorous. They manage export control compliance for international customers, navigate regulatory requirements across different jurisdictions, coordinate with range safety offices and launch providers to ensure all necessary documentation is complete, and handle the insurance and liability issues that inevitably arise when dozens of satellites from different owners share a rocket. For many small satellite operators, particularly university teams and startups launching their first missions, having an experienced integrator manage these regulatory and administrative complexities makes the difference between successfully reaching orbit and getting lost in bureaucratic tangles.

Perhaps most critically, integrators serve as a buffer and translator between the launch vehicle providers and the small satellite customers. Launch providers operate on timelines and with procedures developed for large, expensive satellites backed by major aerospace companies or government agencies. Small satellite operators often have different rhythms, different technical capabilities, and different tolerance for ambiguity and last-minute changes. Integrators translate between these worlds, packaging requirements from launch providers into forms that small satellite teams can work with while managing expectations about schedule flexibility, late manifest changes, and the various uncertainties inherent in spaceflight.

The Major Players: Mapping the Integration Landscape

The launch integration market has consolidated around several major players, each with different geographical bases, specializations, and approaches to the business. Understanding who these companies are and what distinguishes them helps satellite operators make informed decisions about which integrator best fits their particular needs.

Exolaunch has emerged as arguably the dominant player in the launch integration market, with German roots but global operations coordinating hundreds of satellite deployments across multiple launch vehicle providers. Founded in 2010 and originally focused on providing deployer systems and integration services for European small satellites, Exolaunch systematically expanded to become a full-service launch integrator offering end-to-end services from early mission planning through on-orbit deployment. Their growth was fueled by recognizing early that the rideshare market would become substantial and by investing in the infrastructure and expertise needed to serve it at scale.

What distinguishes Exolaunch is their vertically integrated approach where they not only coordinate rideshare missions but also design and manufacture their own deployer systems and separation systems tailored for different satellite configurations. This vertical integration gives them control over the entire deployment chain and allows them to optimize the interface between satellites and launch vehicles in ways that pure middlemen cannot. They've built particularly strong relationships with SpaceX, regularly organizing large manifests for Transporter missions, but they also work with other launch providers including Rocket Lab, giving customers flexibility in launch vehicle selection. Their CargoX deployer system and EcoX separation system represent in-house engineering that addresses specific challenges in deploying diverse satellite configurations reliably.

Exolaunch's European heritage and strong presence in European markets has been both an advantage and a limitation. On the positive side, they've benefited from Europe's robust small satellite ecosystem and from regulatory frameworks in European countries that support commercial space activities. They've also cultivated relationships with European institutional customers and with the European Space Agency's various programs supporting commercial satellite deployment. However, this European focus has sometimes created challenges for American customers navigating export control regulations, and there's been ongoing tension between Exolaunch's European identity and their aspirations to dominate the American market where much of the small satellite growth is occurring.

Spaceflight Inc., once based in Seattle, formerly served as the American counterweight to Exolaunch's European dominance. Founded in 2011, it initially built its business around the emerging rideshare market, aggregating a diverse mix of small satellite customers across multiple launch vehicles. Spaceflight's flexible approach - working with available launch capacity instead of relying on any single provider - helped pioneer the commercial rideshare model in the United States and establish a foundation for small satellite access to orbit.

Over time, however, Spaceflight's trajectory proved less stable than Exolaunch's steady rise. The company underwent restructurings, leadership changes, and several strategic pivots, including ventures into dedicated small launch development through its Spaceflight Industries parent. Those ambitions were ultimately scaled back, and after years of shifting direction, the company was acquired by Firefly Aerospace. That acquisition effectively marked the end of Spaceflight as an independent launch integrator.

While Spaceflight's brand and operations have since been "folded" into Firefly Aerospace's broader service offerings, its decade of experience left a lasting imprint on the American small satellite sector. The lessons learned from Spaceflight's challenges - around export control, rideshare coordination, and the complexity of integrating U.S. commercial and government customers - continue to inform how newer American integrators and launch providers structure their businesses today.

SEOPS Space represents another significant American presence in the integration market, with a particular focus on serving the domestic commercial and government small satellite community through streamlined, responsive integration services. Based in the United States and emphasizing their American operational infrastructure, SEOPS has positioned itself to capitalize on the growing recognition that American satellite operators benefit from working with American integrators, particularly for missions involving export-controlled technologies or government customers. What distinguishes SEOPS is their emphasis on flexibility and customer-centric service delivery, working to accommodate the specific needs of emerging commercial operators and research institutions who may not fit neatly into the standardized processes that larger integrators have optimized for high-volume missions. They've built their business around understanding that not every satellite mission looks the same, that timing and orbital requirements vary significantly across different applications, and that many American satellite developers prefer working with domestic integrators who understand U.S. regulatory frameworks, can navigate American government procurement processes, and operate entirely within U.S. jurisdiction. As the American small satellite industry continues its rapid growth and as more operators recognize the strategic and practical advantages of domestic integration providers, SEOPS is well-positioned to capture an increasing share of the market alongside other American integrators working to provide alternatives to the European-dominated status quo.

Mavericks Space represents a newer entrant taking a fresh approach to the integration market by focusing specifically on responsive, flexible rideshare services that can accommodate late-manifesting customers and changing requirements. Rather than competing head-to-head with Exolaunch's scale, Mavericks is positioning itself around agility and customer service for operators who need more flexibility than traditional rideshare services provide. Their willingness to work with smaller manifests, to accommodate schedule changes closer to launch, and to provide more hands-on support for first-time satellite operators addresses a segment of the market that the larger integrators sometimes struggle to serve profitably.

A notable niche player in the small satellite launch ecosystem is Alba Orbital, a Scotland-based company specializing in PocketQube satellites - miniature spacecraft even smaller than CubeSats. Alba has carved out a distinctive position by designing, manufacturing, and deploying its own family of PocketQube platforms through 'AlbaCluster' rideshare missions. The company claims to have launched more than 100 PocketQubes into orbit using a variety of launchers, including Rocket Lab and D-Orbit, and has collaborated with major integrators such as Exolaunch and SEOPS. This versatile approach underscores Alba's agility and its role in expanding space access for universities, startups, and research institutions operating at the most minor and most affordable scale of satellite development.

Beyond these major integrators, the market includes regional specialists, deployer manufacturers who provide integration services, and various smaller companies serving niche markets or specific geographic regions. In Asia, companies like ISRO's commercial arm provide integration services primarily for the Indian market but increasingly for international customers as well. Japanese integrators have emerged to serve the growing Japanese small-satellite industry. In the United States, companies like Launcher and others are exploring integration services as complements to their primary businesses in launch vehicle development or component manufacturing.

The European Dominance Question: Geography, Infrastructure, and Policy

Examining the launch integration market reveals a pattern that surprises many observers: despite America's dominance in launch vehicle capabilities and the significant American presence in satellite manufacturing, European companies, particularly Exolaunch, have captured disproportionate market share in launch integration services. Understanding why this European dominance emerged and what it means for the industry's future requires looking at the interplay of geography, infrastructure, regulatory environment, and business strategy.

Europe's strong position in small satellite integration partly reflects the European Space Agency's long-standing support for commercial space activities and for developing the industrial base needed to serve the space market. ESA programs have provided funding and support for companies developing integration capabilities, deployer technologies, and the various services needed to support small satellite deployment. This institutional support created an environment where companies like Exolaunch could develop their abilities with some degree of de-risking during the early years when the rideshare market was still proving itself.

European regulatory approaches to commercial space also played a role, with frameworks in countries like Germany and Luxembourg actively encouraging commercial space companies and providing clear paths to licensing and operating in these jurisdictions. While American regulatory frameworks for launch and satellites are mature and well-developed, the European environment for mission integration services, which falls into somewhat ambiguous regulatory territory, has in some ways been more accommodating to new business models.

Perhaps most importantly, European integrators benefited from being early movers who recognized the rideshare opportunity and invested systematically in building the capabilities to serve it at scale. Exolaunch's decision to develop its own deployer systems rather than relying on third-party deployers created proprietary technology that differentiated it and gave it more control over the customer experience. Their willingness to invest in integration facilities, testing capabilities, and the specialized expertise needed to manage complex multi-satellite missions created barriers to entry, making it difficult for later entrants to compete effectively.

However, this European dominance creates some tensions and challenges for the industry, particularly for American satellite operators and for the American government's goals around maintaining domestic space capabilities. Export control regulations mean that American satellites equipped with certain technologies cannot efficiently work with non-American integrators without complex licensing. For government missions or missions with national security implications, there are often preferences or requirements to work with American companies under American jurisdiction. Even for purely commercial missions, some American satellite operators prefer working with American integrators to avoid the complexity of international contracts, currency exchange, and cross-border regulatory coordination.

These factors are creating opportunities for American integrators to gain ground, and there's a growing recognition that the American market can support multiple strong domestic integration companies. Spaceflight's continued presence and evolution demonstrate that American integrators can compete effectively, particularly when serving American customers and leveraging domestic advantages around regulatory familiarity and government relationships. Newer entrants like Mavericks are finding niches where they can provide differentiated value even in a market with established players.

Blackwing Space's Integration Strategy: Partnership and Pragmatism

At Blackwing Space, our approach to launch integration reflects both pragmatic business considerations and strategic goals around building the American small satellite ecosystem. We recognize that our customers will need reliable, cost-effective paths to orbit, and that launch integration is a critical link in the chain between building satellites and operating them on-orbit. However, we also see launch integration as an area where strategic partnerships make more sense for us than trying to become integrators ourselves or committing exclusively to any single integration provider.

Our core competency and strategic focus is building modular, affordable, American-made nanosatellite platforms using automotive-grade components and offering comprehensive "everything-as-a-Service" operational support. Launch integration, while critically important to our customers' success, is not where we believe we can create the most value or achieve sustainable competitive advantage. The integration market already has established players with significant infrastructure investments, accumulated expertise, and economies of scale that would be difficult for us to replicate. Rather than competing in this space, we see more value in partnering with multiple integrators to ensure our customers have a range of options.

However, we're being thoughtful and somewhat selective about these partnerships, deliberately emphasizing building deeper relationships with a handful of American-based integration providers rather than maintaining superficial relationships with every possible integrator globally. This American focus aligns with our broader positioning on American manufacturing and domestic supply chains, and it provides practical advantages for our customers, including greater export control compliance and simpler regulatory requirements. When Blackwing satellites using American-made components launch through American integrators on American rockets, the entire chain stays within U.S. jurisdiction, dramatically simplifying the regulatory picture.

We're particularly interested in integration partners who share our philosophy around standardization, transparency, and customer service. Integrators who publish transparent pricing, maintain predictable schedules, communicate proactively about manifest changes and mission updates, and treat small satellite customers as valued partners rather than minor inconveniences align with how we want to work with our own customers. We're looking for integrators who understand that university teams and startups often need more hand-holding and support than established aerospace companies, and who've built their operations to provide that support efficiently.

Our integration partnerships also serve a strategic function in our broader ecosystem development. By working closely with a select group of integrators, we can coordinate on technical interfaces to ensure our satellites integrate smoothly with their deployers and processes. We can work together on timing and logistics to align our manufacturing schedules with integration timelines and launch windows. We can potentially bundle our services with their launch capacity, offering customers complete mission solutions from satellite delivery through on-orbit deployment and operational support. These deeper partnerships create value beyond what pure transactional relationships with many integrators could provide.

At the same time, we're maintaining the flexibility to work with other integrators when specific mission requirements or customer preferences make that appropriate. If a customer has an existing relationship with a particular integrator they trust, or if specific orbital requirements mean only confident integrators can provide suitable missions, we'll work with those providers even if they're not among our core partners. Our goal is to never be the constraint that prevents a customer from accessing the right launch opportunity, while still channeling most of our volume to partners with whom we can build mutually beneficial strategic relationships.

The Future: Trends Reshaping Launch Integration

Looking ahead, several trends are likely to reshape the launch integration market, creating both challenges and opportunities for integrators, satellite operators, and companies like Blackwing that are building the broader small satellite ecosystem. Understanding these trends helps inform the decisions we make today about partnerships, capabilities, and business models that will need to adapt as the market evolves.

The increasing cadence and standardization of rideshare missions, particularly through programs like SpaceX's Transporter series, is transforming integration from a bespoke service into something more like a commodity transportation service. When rideshare missions fly monthly or even more frequently, when pricing is published and relatively standardized, when processes are well-established, and requirements are precise, the integration business starts to look less like aerospace systems engineering and more like logistics and operations management. This commoditization creates pressure on integrator margins and requires them to achieve operational efficiency and scale to remain profitable.

The emergence of new launch vehicle providers, tiny launch vehicle companies offering dedicated missions for small satellites, creates both competition and complementarity for rideshare integrators. On one hand, some satellite operators who might have used rideshare will instead purchase dedicated small launches that give them more control over orbit, schedule, and mission parameters. On the other hand, small launch vehicles create new integration opportunities as these providers also need help aggregating customers and managing multiple satellite deployments, even on smaller missions. We may see integration services bifurcating between high-volume, commodity rideshare integration and more specialized, higher-touch integration for dedicated small launches.

Evolving regulatory frameworks around space traffic management, debris mitigation, and orbital sustainability will likely increase the complexity of integration services and create new opportunities for integrators to provide value. As requirements around deorbit plans, collision avoidance, and space sustainability become more stringent, integrators who can help satellite operators navigate these requirements and demonstrate compliance will differentiate themselves. The administrative and regulatory coordination functions that integrators already provide may become even more valuable as the regulatory environment becomes more complex.

The growth of constellation missions deploying tens or hundreds of satellites creates a different integration model, in which a single customer must deploy many satellites across multiple launches over extended periods. Integrators who can provide consistent, repeatable deployment services for constellation operators, manage the logistics of frequent launches and complex manifest coordination, and offer pricing and scheduling certainty across multi-launch campaigns will serve a market segment quite different from the diverse, one-off customer base that characterized early rideshare.

For Blackwing Space, these trends reinforce our strategy of partnering with a handful of key strategic integrators rather than trying to own integration in-house. As the market evolves and potentially fragments into different service tiers and specializations, having relationships with different integrators serving different niches gives us and our customers flexibility to match specific needs with appropriate providers. Our focus remains on building excellent satellite platforms and comprehensive operational services, working with the best integration partners to connect our satellites with the launch opportunities our customers need.

The launch integration market has evolved from informal secondary payload arrangements into a sophisticated, multi-hundred-million-dollar industry that's essential infrastructure for the small satellite economy. Companies like Exolaunch, SEOPS Space, Spaceflight, and Mavericks have built businesses around the complex coordination required to aggregate customers, manage technical integration, navigate regulatory requirements, and ultimately deliver satellites safely to orbit on shared missions. Understanding this ecosystem, knowing who the major players are and what services they provide, recognizing the dynamics around European versus American providers, and thinking strategically about how to work with integrators effectively has become essential knowledge for anyone operating in the small satellite industry. At Blackwing Space, we see these integration providers not as competitors but as essential partners in our mission to democratize access to space through affordable, modular, American-made nanosatellite platforms.