YC and Techstars Space Founders: Stop Building Spacecraft Buses

Why accelerator backed space startups should focus on payload innovation and outsource the spacecraft platform

Y Combinator and Techstars have funded some of the most innovative space companies of the past decade. From Earth observation to space manufacturing, from orbital logistics to communications constellations, accelerator alumni are reshaping the space industry with software speed and startup economics.

But there is a pattern among early stage space startups that burns cash, extends timelines, and kills companies before they can prove their core value proposition: trying to build the entire spacecraft from scratch.

If you are a YC or Techstars space founder, here is the hard truth: your investors funded your payload technology, not your ability to build power systems and attitude control. Your competitive advantage is what goes inside the satellite, not the bus that carries it. And every dollar and engineer hour you spend on commoditized spacecraft platform work is a dollar and hour not spent on the innovation that justifies your valuation.

This article explains why accelerator backed space startups should ruthlessly focus on payload development and use commercial platforms like Blackwing Space for everything else.

The Accelerator Space Portfolio: A Pattern Emerges

Y Combinator and Techstars have impressive track records in space. Companies that have gone through these programs have raised hundreds of millions in follow on funding and are genuinely advancing the industry.

What These Companies Have in Common

Look at the successful accelerator space companies and you will notice something: they all have a specific technology or application that is defensible and valuable.

- Earth Observation Startups: Their value is not in building satellites. It is in the sensors, the algorithms, the data processing, the customer delivery pipeline. The spacecraft bus is just the platform that gets the camera to orbit.

- Communications Companies: The defensible technology is the radio design, the network protocol, the ground infrastructure, the spectrum licenses. The satellite platform is necessary but not differentiating.

- In Space Manufacturing: The value is the manufacturing process, the materials science, the automation. The spacecraft that hosts the experiment is important but commoditizable.

- Orbital Services: Whether it is debris removal, inspection, or logistics, the value is in the mission capability and operations. The bus that enables that mission is a means to an end.

In every case, the payload or mission is the business. The spacecraft platform is infrastructure.

The Fatal Mistake: Building Everything

Despite this obvious pattern, many accelerator space startups make the same mistake. They allocate engineering resources to building custom spacecraft platforms because they believe it gives them more control, because they underestimate the difficulty, because they want to own everything, or because they mistakenly think the platform is their competitive advantage.

The result is predictable: 12 to 18 months into development they are debugging power systems instead of refining their payload. They are hiring electrical engineers to design PCBs instead of hiring domain experts for their core technology. They are spending limited seed capital on spacecraft integration rather than customer development. And they are watching their runway decrease while their time to orbit increases.

This is not a sustainable approach for a startup with 18 months of cash and a need to show traction for Series A.

The Seed Stage Economics Problem

Accelerator backed space startups typically raise between $1M and $3M in seed funding after demo day. This sounds like a lot of money until you start building spacecraft.

What It Actually Costs to Build a Spacecraft Platform

Let us look at realistic costs for a team trying to build a custom CubeSat platform from scratch:

- Engineering Team: You need at minimum 2 to 3 engineers working full time on the platform for 12 to 18 months. At startup salaries in competitive markets, that is $300K to $500K in fully loaded costs.

- Prototyping and Testing: Multiple PCB spins, component procurement, environmental testing equipment rental or service, vibration testing, thermal vacuum testing. Budget $50K to $150K depending on how thorough you are.

- Integration and Qualification: Structure procurement, deployer compatibility testing, mass properties measurement, documentation for launch providers. Add another $30K to $80K.

- Regulatory and Compliance: FCC licensing, frequency coordination, NOAA remote sensing licensing if applicable, export control compliance. Budget $20K to $50K in legal and filing fees.

- Opportunity Cost: While your team builds the platform, they are not building the payload, talking to customers, or refining the business model. This cost is harder to quantify but potentially the most expensive.

Total cost to develop a minimally viable spacecraft platform: $400K to $800K and 12 to 18 months. That is 30 to 60 percent of a typical seed round spent on undifferentiated infrastructure.

The Alternative: Buy the Platform

Now consider the alternative approach. A Blackwing Space platform costs $10K to $100K depending on size and configuration. Integration support is included. Delivery is 6 to 9 months. No engineering team required for platform development.

Your $2M seed round now looks very different. Instead of spending $500K on platform development, you spend $50K on a flight proven platform. That extra $450K funds 18 months of payload development, customer pilots, or additional hiring for your core technology.

The math is not even close. Buying the platform is 10x more capital efficient than building it.

The Time to Market Advantage

For venture backed startups, speed matters almost as much as capital efficiency. Your investors expect to see progress on specific milestones before they will fund the next round.

Critical Milestones for Series A

Space startups typically need to demonstrate several things to raise Series A funding:

- Technology Validation: Your payload or mission capability works as claimed, preferably with flight demonstration data.

- Customer Traction: Letters of intent, pilot agreements, or actual contracts showing market demand.

- Team Execution: You have built and launched something on time and on budget, proving you can execute.

- Scalability Path: Clear roadmap from technology demonstration to commercial operations.

Notice what is not on this list: proving you can build spacecraft buses.

The 18 Month Window

Most seed stage startups have 18 to 24 months of runway to hit Series A milestones. In the space industry, this timeline is incredibly tight.

If you spend 12 to 18 months developing a custom spacecraft platform, you launch right as you run out of money. You have no flight data for Series A pitches. You have not had time to iterate based on actual space operations. And you are trying to raise your next round based on promises rather than demonstrated results.

In contrast, if you use a commercial platform and launch in 6 to 9 months, you get 6 to 12 months of on orbit operations before your Series A raise. You have real flight data showing your payload works. You have operational lessons that inform your next generation design. And you have proof of execution that makes investors confident in your ability to scale.

This timing difference can be the difference between getting funded and shutting down.

The Risk Equation for Investors

When YC or Techstars partners introduce you to Series A investors, those investors are evaluating risk. Every technical assumption you are making is a risk factor in their model.

Technical Risk Stacking

If you are building both the payload and the platform, you are stacking technical risks:

- Payload Risk: Will your core technology work as claimed in the space environment?

- Platform Risk: Will your custom spacecraft bus provide reliable power, communications, and attitude control?

- Integration Risk: Will the payload and platform work together reliably?

- Operations Risk: Can you successfully command and control the spacecraft?

Investors see this risk stack and either pass or discount your valuation substantially. Why would they fund a company with four major technical unknowns when they could fund one with only one or two?

De Risking Through Commercial Platforms

Using a flight proven platform like Blackwing eliminates most platform related technical risk:

- Platform Risk: Eliminated. The platform has flight heritage and proven performance.

- Integration Risk: Reduced. Standard interfaces and integration support from Blackwing minimize this risk.

- Operations Risk: Reduced. Standard command and control procedures are documented and proven.

Now your investors are only betting on your payload technology and your ability to execute on your core mission. This is a much more attractive risk profile, which translates to higher valuations and easier fundraising.

The Focus Problem: Startups That Try to Do Everything

There is a tendency in space startups to want to own the entire value chain. This comes from aerospace heritage where vertical integration was necessary because suppliers did not exist or were unreliable.

Aerospace Legacy Thinking vs Startup Reality

- Traditional Aerospace: Large defense contractors build everything in house because they have the capital, timelines are measured in decades, and supplier bases were immature.

- Startup Reality: You have limited capital, 18 month milestones, and a mature supplier ecosystem for commoditized spacecraft components.

Applying aerospace thinking to a startup environment is a category error. You do not have the resources for vertical integration, and the market no longer requires it.

What Accelerators Teach About Focus

YC and Techstars drill one lesson into every batch: focus on your core competency and outsource everything else.

This is standard startup advice for a reason. Companies that try to build everything burn through capital and time faster than focused companies. They spread engineering talent too thin. And they fail to build defensible advantages in any area because they are adequate at everything rather than excellent at one thing.

This advice applies to space startups just as much as it applies to SaaS companies. Your core competency is your payload technology, not your ability to design power systems.

Case Study Pattern: What Actually Works

While we cannot name specific companies without permission, there is a clear pattern among successful accelerator space startups.

The Successful Approach

- Stage 1: Technology Validation - Build a payload prototype, test it on the ground and on suborbital flights, prove the core technology works.

- Stage 2: Space Demonstration - Integrate the payload onto a commercial platform, launch quickly to demonstrate in space environment, collect flight data and iterate.

- Stage 3: Commercial Operations - With proven technology and flight heritage, raise Series A to scale operations, build or buy production platforms optimized for your specific mission.

Notice that the platform build happens in Stage 3 after you have flight data, customer validation, and Series A capital. You are not betting scarce seed capital on platform development.

The Failure Pattern

In contrast, startups that struggle often follow this pattern:

- Stage 1: Build Everything - Allocate substantial seed capital to custom platform development, payload development happens in parallel but with insufficient resources.

- Stage 2: Integration Crisis - Platform takes longer than expected, payload is not ready, integration reveals incompatibilities, schedule slips and costs increase.

- Stage 3: Cash Crunch - Company runs out of money before launch or right after launch, no time to demonstrate value before needing Series A, cannot raise or raises at unfavorable terms.

The difference between these patterns is not technical sophistication. It is strategic focus and capital allocation.

Blackwing Space: The Platform for Accelerator Startups

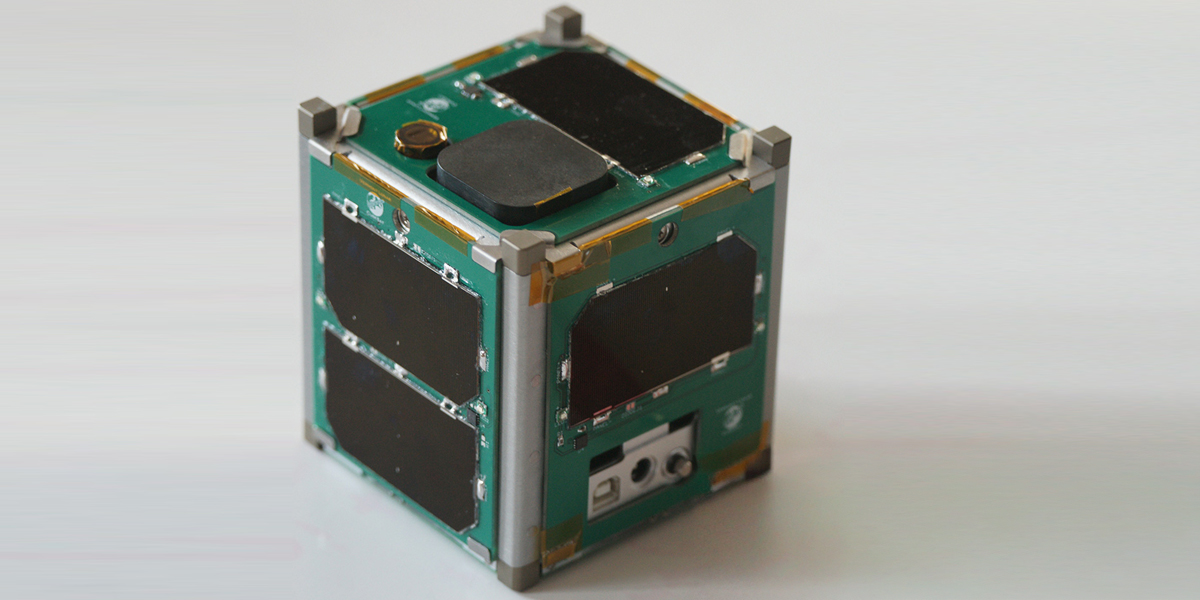

Blackwing Space was built specifically for the economics and timelines that matter to venture backed startups.

What Makes Blackwing Different

- Transparent Pricing: No surprise costs or hidden fees. You can budget accurately from day one.

- Rapid Delivery: 6 to 9 month delivery timelines get you to orbit fast enough to matter for your milestones.

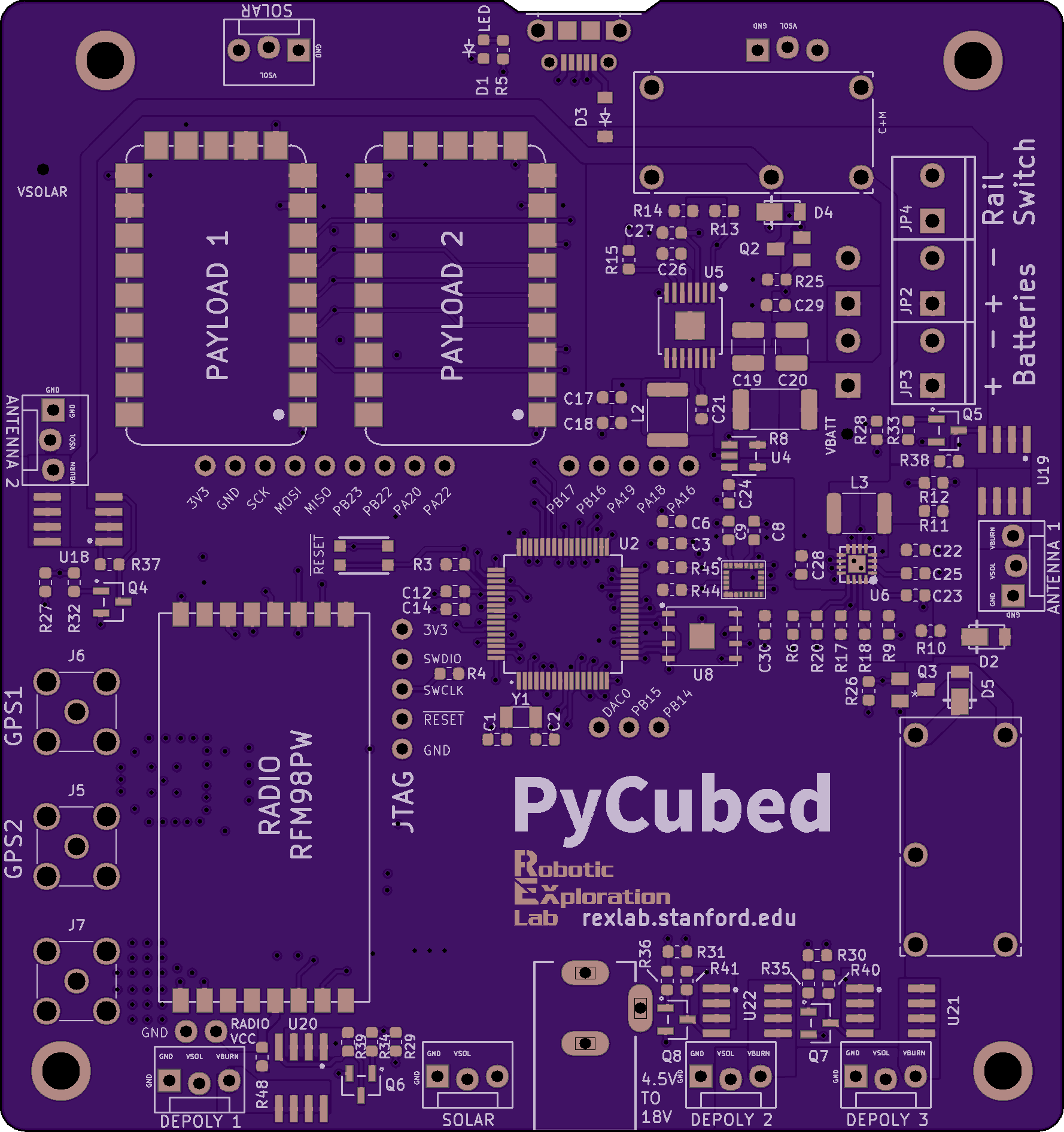

- Standard Interfaces: PC104 compatible payload stacks, standard power and data interfaces, minimal integration complexity.

- American Manufacturing: Domestic supply chain means ITAR compliance is straightforward and delivery is reliable without international shipping risks.

- Flight Proven Heritage: PyCubed derived design with demonstrated flight success reduces technical risk.

- Support Included: Integration support, testing guidance, and launch coordination help ensure success even for first time teams.

The Startup Value Proposition

For a seed stage space startup, Blackwing provides exactly what you need:

- Capital Efficiency: Platform cost is 2 to 5 percent of your seed round rather than 30 to 50 percent if you build custom.

- Speed to Orbit: Launch in 9 to 12 months from contract rather than 18 to 24 months with custom development.

- Risk Reduction: Proven platform eliminates a major technical risk factor for Series A investors.

- Focus Preservation: Your engineering team works on payload and mission rather than power systems and radio drivers.

This is not about choosing the cheapest option. It is about choosing the strategically correct option for venture backed companies with limited time and capital.

The Payload Focus Advantage

When you use Blackwing for the platform, your entire team can focus on what actually matters: your payload and mission.

What You Should Be Building

- Payload Technology: Your unique sensor, instrument, or manufacturing capability that is your competitive advantage.

- Data Processing: Algorithms that turn raw data into valuable information for customers.

- Ground Infrastructure: Operations systems, customer delivery pipelines, and automation that scales.

- Customer Development: Pilot programs, partnerships, and commercial traction that validates market demand.

These are the things that justify your valuation and enable Series A fundraising. These are where your scarce engineering talent should be allocated.

What You Should Not Be Building

- Power Systems: Solar panel MPPT controllers, battery management, voltage regulation. These are commoditized and available commercially.

- Attitude Determination: IMU interfaces, magnetometer drivers, sensor fusion. Use standard solutions rather than reinventing.

- Communications: Radio drivers, modulation schemes, protocol stacks. Leverage existing implementations.

- Thermal Management: Temperature sensing, heater control, thermal analysis. Use proven designs.

Every engineering hour spent on these commodity functions is an hour not spent on your core technology. This is a losing trade for venture backed companies.

Common Objections and Why They Are Wrong

Objection 1: We Need Custom Integration

The Concern: Our payload has unique requirements that commercial platforms cannot support.

Reality: Most payload requirements fit within standard platform capabilities. Power budgets, data rates, and pointing requirements that seem unique are usually within the range of commercial platforms like Blackwing. For truly custom requirements, platform vendors can often accommodate modifications faster and cheaper than you can build from scratch.

Test: Before assuming you need custom, actually specify your requirements numerically and check them against commercial platform specs. Most teams discover their requirements are not as unique as they thought.

Objection 2: We Want to Own the IP

The Concern: Using a commercial platform means we do not own critical technology.

Reality: The IP that matters is in your payload, not in the commodity spacecraft bus. Owning power system IP does not create a defensible business advantage. What creates moats is proprietary payload technology, customer relationships, operational data, and market position.

Example: SpaceX did not build their own rocket engines because they wanted to own engine IP. They built them because commercial alternatives did not exist or were too expensive. If reliable commercial engines had been available at reasonable cost, they would have used them and focused on integration and operations.

Objection 3: We Can Build It Cheaper

The Concern: We can build a platform for less than commercial prices by doing it ourselves.

Reality: This is the classic build versus buy fallacy. You are only counting direct material costs and ignoring fully loaded engineering time, prototype iterations, testing expenses, opportunity costs, and schedule risk. When you do honest accounting including all these factors, commercial platforms are almost always cheaper for seed stage companies.

Math: Your team building custom will spend at minimum 6 engineer months at $150K fully loaded cost. That is $75K before parts, testing, or schedule slips. You are not saving money. You are miscounting costs.

Objection 4: We Are a Spacecraft Company

The Concern: Building spacecraft platforms is part of our core business.

Reality: No, your core business is your payload application. You are an Earth observation company, a communications company, or a manufacturing company that happens to operate in space. Unless you are literally trying to become a bus vendor competing with Blackwing and others, the platform is not your product.

Strategic Clarity: Get clear on what business you are actually in. If you are building platforms to sell to other companies, fine, build platforms. If you are using satellites as tools to deliver payload services, buy the platform and focus on the service.

The Techstars and YC Alumni Advantage

If you have gone through Techstars or YC, you have specific advantages you should leverage when working with Blackwing.

Network Effects

- Accelerator Network: Other space alumni who have made the build versus buy decision can advise you. Ask them directly whether they would make the same choice again.

- Investor Alignment: Your seed investors understand startup economics and will support the decision to buy rather than build if you frame it correctly as capital efficiency and risk reduction.

- Mentor Guidance: Your accelerator mentors have seen hundreds of companies make strategic decisions. Get their input on the platform decision.

Startup Discipline

Accelerators teach you to move fast, validate assumptions quickly, and focus ruthlessly. Apply these lessons to the platform decision:

- Move Fast: Using Blackwing gets you to orbit in 9 to 12 months versus 18 to 24 months custom. Speed is a competitive advantage.

- Validate Assumptions: Launch quickly with a commercial platform to test your actual mission assumptions before committing to custom hardware.

- Focus Ruthlessly: Put every resource toward payload development and customer traction. Do not get distracted by platform work.

Pricing and Options for Startups

Blackwing offers three platform options designed for different mission scales:

Sparrow 1U: Technology Demonstration

Best For: Initial space validation of payload technology, small sensors or instruments under 500g, proving space readiness before scaling.

Startup Use Case: Pre seed or early seed companies that need space heritage data for investor pitches. Launch a 1U demonstration mission for less than most prototype builds cost.

Kestrel 3U XL: Primary Missions

Best For: Operational payload demonstrations, larger sensors and instruments up to 2kg, missions requiring substantial power or data.

Startup Use Case: Seed stage technology demonstrations that need to show commercial viability. The most common choice for accelerator backed companies.

Osprey 6U XL: Advanced Missions

Best For: Complex payloads requiring significant volume and power, missions with multiple instruments or experiments, constellation pathfinders.

Startup Use Case: Series A stage companies scaling from demonstration to commercial operations, or well funded seed companies with substantial payloads.

Volume Discounts for Constellations

If your business model requires multiple satellites, Blackwing provides volume pricing for constellation orders. After you have proven your payload with the first unit, scaling to production quantities becomes more cost effective per satellite.

How to Approach the Platform Decision

If you are a YC or Techstars space founder currently debating whether to build or buy your spacecraft platform, here is a decision framework:

Step 1: Calculate True Build Costs

- Do honest accounting of what building custom would actually cost including fully loaded engineering salaries, prototyping and testing, schedule risk and contingency, and opportunity cost of delayed launch.

- Most teams underestimate by 2 to 3x when they first calculate build costs.

Step 2: Define Your Technical Requirements

- Write down specific numerical requirements for power generation and storage, pointing accuracy and control, data rates and storage, volume and mass budget, and environmental conditions.

- Check these against Blackwing specs before assuming you need custom.

Step 3: Map Your Milestone Timeline

- When do you need flight data for Series A? How much runway do you have? What are your investor expectations for progress?

- If you need to launch within 12 months to hit milestones, custom platforms are not viable.

Step 4: Assess Your Team Capabilities

- Do you have experienced spacecraft engineers on your team? Have they built flight hardware before? Are they available full time for platform development?

- Be honest about expertise gaps. Inexperienced teams building custom platforms usually fail.

Step 5: Calculate Risk Impact on Valuation

- Talk to Series A investors about how they evaluate technical risk. How much does using flight proven platforms versus custom platforms affect their willingness to invest and at what valuation?

- The valuation difference often exceeds the cost savings of building custom.

Step 6: Make the Decision

- For most seed stage accelerator backed space startups, the decision should be clear: buy the platform and focus on payload.

The rare exceptions are companies with substantial non dilutive funding, teams with deep spacecraft heritage, missions with genuinely unique requirements that commercial platforms cannot meet, or strategic objectives that require platform IP ownership.

For everyone else, buying the platform is the correct strategic choice.

Getting Started with Blackwing

If you have decided to focus on your payload and use Blackwing for the platform, here is how to move forward:

Initial Consultation

Contact Blackwing to discuss your mission requirements, payload specifications, launch timeline, and budget constraints. This consultation helps determine which platform option fits your needs and identifies any integration considerations.

Requirements Review

Provide detailed payload specifications including power requirements, data rates, volume and mass, pointing and stability needs, and thermal constraints. Blackwing engineering will review these and confirm compatibility or suggest modifications.

Integration Planning

Work with Blackwing to plan payload integration including mechanical interfaces and mounting, electrical connections and data protocols, testing and qualification approach, and delivery and launch coordination.

Contract and Delivery

Standard delivery timeline is 6 to 9 months from contract signature. This includes platform manufacturing and testing, payload integration support, environmental qualification, and launch readiness verification.

Conclusion: Focus on What Matters

YC and Techstars have proven that startups can compete in space by applying software economics and startup speed to an industry that historically moved slowly. But success requires focus.

Your investors backed you because of your unique payload technology or mission capability. They did not back you to become a spacecraft bus manufacturer. Every resource you allocate to building commodity spacecraft platforms is a resource not spent on your competitive advantage.

Blackwing Space provides a better path. Use flight proven platforms that cost 10x less than custom development and launch 12 months faster. De risk your technology for Series A investors by eliminating platform technical risk. And focus your entire team on the payload and mission work that actually creates value.

The question is not whether you can build a spacecraft platform. The question is whether you should. For venture backed startups with limited time and capital, the answer is almost always no.

Build your payload. Buy your platform. Launch fast. Prove your technology. Raise your Series A. Scale from there.

That is the path that works for accelerator backed space startups. Everything else is a distraction.

Ready to discuss how Blackwing platforms enable your mission? Contact the team to review your requirements and timeline: sales@blackwingspace.com or call 615-933-2706.